Бесплатный фрагмент - The Book about Cryptocurrency №1

Second edition expanded

Preface

to the second edition

⠀

«Cryptocurrency Book №1» was written in 2018—2019.

At that time, the cryptocurrency market was booming, new coins appeared every day, trading was active, the bitcoin rate fluctuated in the corridor from 3 to 7 thousand $ (ridiculous figures at the level of current prices). Facebook and Telegram announced the launch of their blockchain projects, the capitalization of cryptocurrencies grew to almost $200 billion.

Over the past five years, the cryptocurrency industry has changed enormously. New directions, interesting projects have appeared, large international companies are growing, such as Binance, which we had the honor to assist in its expansion in the CIS market.

A few years ago, the terms DeFi (decentralized finance), DEX (decentralized exchanges), NFT (non-fungible tokens) were not yet in circulation. And now these are commonplace.

The world of cryptocurrencies has become more complex, more interesting, more dynamic. Our company, Pro Blockchain Media, has changed dramatically. We have turned from a small project into an international media agency. We have won many awards, launched hundreds of advertising campaigns and developed strategies for the best players in the cryptocurrency market.

In addition to our media agency, we also created bitbrain.me cryptoacademy and its main product — a closed community and investment club called DeFi Hunters. With over 1300 members from all over the world, DeFi Hunters is the best crypto community in the CIS region (although community members have been living in different cities and countries for a long time, it’s time to open local branches). We invite you to explore our Bitbrain Academy and join our vibrant community.

Over the past five years, we’ve produced thousands of videos on our YouTube channels, providing free access to knowledge about new technologies to people around the world. We’ve also written several other books, excerpts from which we’ll share with you in this updated version of the #1 Cryptocurrency Book. This book has become a bestseller in the CIS region, with almost 400,000 copies sold, and we are grateful for the feedback from our readers that prompted us to release this updated edition.

As we continue to work, develop and learn, we are committed to sharing the best content with you. That’s why we have updated some chapters of the book, added a separate chapter about DeFi, AirDrop and bitcoin mixers.

We hope that the new edition of our book will inspire you to new discoveries and actions in the ever-evolving world of cryptocurrencies. Remember, we are the keepers and creators of our own happiness and our own path.

Enjoy the journey!

Vyacheslav Nosko and Maxim Burkov

Beginnings…

A letter from the future

⠀

In 2013, a text appeared on Reddit.com, the author of which called himself Luka_Magnotta. The published entry detailed what planet Earth would turn into in the future. The letter from the future was dated 2025.

What was the mysterious author warning about? And now, when we have almost reached his time of living, what of the predictions — the truth, and what — so far — fantasy?

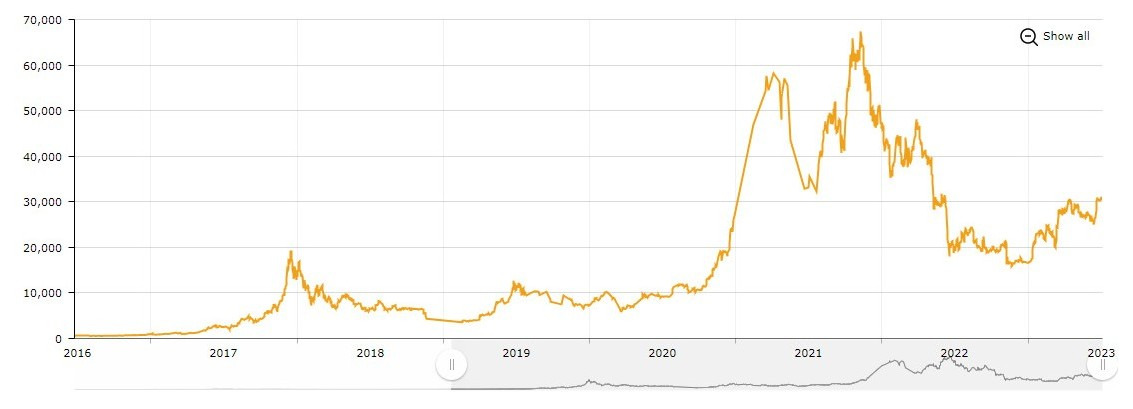

Every year, the price of bitcoin has risen 10 times on average. From $0.1 in 2010 to $1 in 2011, then to $10 in 2012 and $100 in 2013. Then the growth slowed down a bit, with the value increasing tenfold every two years: to $1,000 in 2015, to $10,000 in 2017, to $100,000 in 2019, and to $1,000,000 in 2021.

Well, so far it hasn’t reached the value of $100,000 per bitcoin, with the maximum bitcoin price reaching $68,789.63 in November 2021. After the decline in 2022, we are seeing the cryptocurrency rise again, so we may see Luka’s prediction gradually come true in the medium term.

Luka has raised major issues and described the fears of many opponents of cryptocurrency as coming true in the not-too-distant future. The author cites the price for 1 BTC in different years. Part of the predictions came true, the value of the coin roughly corresponded to reality.

As of 2019, Luka is wrong by a whole order of magnitude. Bitcoin is not worth $1 million, and so far its price has not even reached $100 thousand. The volatility of the asset does not allow you to make far-reaching predictions.

It is known that more than 19 million bitcoins have been issued in the world today. Several million have been permanently lost. The population of the planet is still just over 7 billion people.

And here is this prediction almost matches reality as of July 2023. The world has already mined 19,425,118 bitcoins. In general, this figure has already been calculated mathematically, based on the peculiarities of the mining algorithms. The maximum possible number of bitcoins is 21 million coins. Because of the mathematical model governing the issuance of bitcoins, it will take even more than 100 years to mine the remaining 9%. However, already, according to various reports, about 6 million bitcoins have been irretrievably lost. So because of the limited number of coins, it is logical to assume that the rate will grow even more, eventually reaching both $100,000 and a million dollars.

There are already more than 8 billion people on earth, of which, according to various data, from 100 million people or more own cryptocurrency.

Bitcoin blockchain data shows that there are currently more than a billion wallet addresses. But people may have more than one wallet or store their bitcoins on centralized custodial exchanges, making it difficult to estimate the actual number of people using bitcoin in the world.

In a letter from the future, Luka_Magnotta mentions Citatel (Citadels) — closed and fortified cities where bitcoin mining machines are located. Perhaps such cities have already appeared and will eventually really become free territories, uncontrolled by any states.

Now most bitcoins are mined in the United States, Kazakhstan, Canada, and Russia. Just in these countries Citadels will probably appear.

Further Luka_Magnotta predicts a complete collapse of traditional states.

In my world, which will soon become your world, most governments no longer exist because bitcoin transactions are anonymous and therefore most governments are unable to organize taxation of their citizens. Bitcoin’s success is primarily due to the fact that it has proven to be an effective method of hiding wealth from the government. At first, people entering «rogue countries» (such as Luxembourg, Monaco, and Liechtenstein) were chased by drones to ensure that the government knew who was trying to hide their wealth. Then, when people started hiding their funds using bitcoins, the government no longer had ways to control the process.

So far, complete anarchy has not happened on Earth, governments are working. But here’s a prediction about the use of unmanned drones could very well become a reality. UAVs are increasingly being used for both military and civilian purposes.

The economy is growing at about 2% per year. Why? Because if you have more than 0.01 bitcoin, you are probably not doing anything with your money. There is no inflation, and therefore no incentive to put your money anywhere.

And that prediction hasn’t materialized so far. Perhaps because cryptocurrencies have not yet displaced other assets and there is not yet a critical mass of owners who can only live off of the coin’s steady appreciation.

And further in the letter, the author increasingly thickens the colors, as if immersing the reader in a fantastic world of cyberpunk and post-apocalypse.

What happened to the Winklevoss twins? The Winklevoss twins were among the first to die. After the damage to society became clear, terrorist movements began to emerge that sought to hunt down and kill anyone they knew had a large hoard of bitcoins or who they believed was responsible for developing the cryptocurrency. Ironically, these terrorist movements use bitcoin to anonymously fund their operations.

The Winklevoss twins are fortunately doing just fine, their fortune in cryptocurrencies has long exceeded a billion dollars, the brothers have launched the Gemini platform, within which they have implemented their own unique key-holding scheme.

What other unpleasant things did Luka prophesize?

• Owners of large amounts of bitcoins are forced to go into hiding, change their identity.

• A quarter of bitcoin holders fell into the hands of extortionists and were tortured.

• In Africa there was a «tragedy» when 60% of the accumulated crypto-money was lost as a result of a hacker attack on cell phones that could be used to access the state ID and bitcoin wallet. These events sparked a wave of civil wars on the African continent, confusion and chaos that only the governments of Saudi Arabia and North Korea were able to stop.

• An underground network of rebels is preparing a powerful hacking attack on nuclear warhead control centers to launch several missiles and destroy major cities where computers are concentrated.

At the end of the letter, the author admits that the bitcoin situation has reached a dead end and this damned project must be destroyed now to prevent a nuclear winter in a few years.

So far, the identity of the author of this letter has never been established. Definitely the nickname Luka Magnotta is a pseudonym. The letter made a noise, quickly spread on specialized and not only resources, it was copied by hundreds of sites and translated into almost all languages of the world. There are also rumors that the message from the future was written by the same person (or group of people) who hides under the name of Satoshi Nakamoto — the creator of the first protocol for cryptocurrencies.

Be that as it may, so far the information voiced in the text is partially coming true. But in recent years we can see that blockchain technology is not only a market for cryptocurrencies, but also many other niches for application.

Bitcoin and other cryptocurrencies have emerged from blockchain technology (we will talk more about this in the first part of the book).

Blockchain today can be compared to the Internet as it was when it emerged back in the 1980s.

The technology is constantly evolving, and we may see many different applications in the future.

First of all, blockchain is associated with cryptocurrencies and payment systems that allow you to anonymously send money to anyone who has their own cryptocurrency wallet.

Besides the usual cryptocurrencies, this list includes utility tokens, digitized stocks, natural asset tokens, stablecoins, etc. At the end of 2020, there were about 1,000 different cryptocurrencies. In 2022, the number of them is more than 20 thousand units.

Another direction where blockchain technologies are applied is decentralized finance and DEX exchanges. Over the past five years, this direction has been actively developing, and only a lazy person has not heard about NFT. This topic deserves a separate conversation, so in this edition of the book there is an additional chapter about DeFi.

This sector falls into the category of rapid development with the help of innovative developments. Decentralized finance can include instruments created on the basis of blockchain and operating with the help of smart contracts.

While bitcoin has traditionally been opposed to fiat money and classical financial institutions, we see blockchain technology increasingly penetrating the banking industry. Blockchain can make global payments and money transfers faster and cheaper by eliminating intermediaries and intermediate steps. This can lead to lower fees and more efficient cross-border payments. Also, blockchain technology allows issuers and investors to issue and trade securities, such as stocks or bonds, directly and without intermediaries. This can simplify the process of raising capital and increase the availability of financing for SMEs. Blockchain can help banks improve customer verification and anti-money laundering processes through the creation of secure and shared databases. It can reduce costs and improve accuracy in meeting regulatory requirements. And blockchain can also provide transparency and immutability of financial data, which can be useful for record keeping and auditing. It can also help improve security and protection against data manipulation. In the future, no one will examine the credit history as the information will be shown due to the registry in blockchain.

International trade. In this sector, working with smart contracts makes it possible to simplify the issuance of customs invoices, licenses, certificates and other documents. All this is achieved through the speed of transactions and automation of processes. The development of this trend will reduce overall costs, time to clear cargo and reduce corruption.

Impact on value creation. Blockchain gives additional transparency, any transactions can be traced in data chains, ensuring reliability. This creates global value chains for goods. Future improvements in the technology will lead to transformations from cost reduction to increased efficiency, utilizing new operating models.

As we can see, so far the dire predictions of a global catastrophe have not come true. But in some ways, the mysterious Luka was right: blockchain, bitcoin and other currencies have changed our lives irrevocably.

From the authors: who we are and why we can be trusted

Hi! If you are reading this book and are already fascinated by the topic of cryptocurrencies, you are probably sure that crypto is a new age currency and that in time the world will change a lot thanks to it. What, in fact, the author of the letter from the future has already warned us about.

Most likely, you already realize that you can make good money on crypto. Maybe you are already counting the millions that you will have after the next jump of bitcoin or another coin?

It is and… it isn’t.

There is an illusion in the mind of the average person that you can make quick money with cryptocurrency. Buy bitcoins and ethers and wait for their value to increase many times over.

However, the crypto market is subject to general market laws, and there is much in it from traditional trading.

Although there is no denying that this market is more accessible, the entry threshold is minimal, unlike the stock market.

It is impossible to enter this market from scratch and lose nothing if you behave unwisely and wastefully on the market without analyzing information and knowing the principles of work. At least, our personal experience and the experience of other crypto traders confirms this. We ourselves started working with cryptocurrencies in 2015 and saw how the market was growing, the number of exchanges, coins and tokens. And we ourselves were at a disadvantage and spent hours and hours of time and hundreds and thousands of dollars of personal funds to figure it all out.

So, who are we?

We are Maxim and Vyacheslav, the creators of the media platform Pro Blockchain, where you can see what’s happening with the cryptocurrency market in real time. This is the leading media on cryptocurrency in the CIS countries.

We run a YouTube channel, a channel on Telegram, we are on social networks — Vkontakte, Facebook and Twitter.

The ecosystem of our products already has a total of 500,000 people. Every month we have 50,000 unique visitors to our website, the audience of our Telegram channel (56,000 subscribers) and YouTube (200,000 subscribers) is growing.

On the YouTube channel we regularly broadcast live and thematic broadcasts and answer users’ questions.

Experts in crypto and investing often come to visit us. They share their experience and their thoughts on the market situation.

If you regularly read, watch, listen to Pro-blockchain materials, you will gradually begin to understand what is happening in the crypto market and where this, perhaps, the youngest and fastest growing global market is moving.

The channel and all resources named Pro Blockchain Media are our educational endeavor. It’s not the first year we have been densely involved in the topic of cryptocurrencies, we want to share knowledge and help others to better understand the technology, which we are sure is the future. The future is interesting and full of opportunities for everyone who is ready to learn, delve into it, and take risks.

We have personally, through our own experience, studied how the cryptocurrency market works, and we continue to study, monitor it and keep track of meaningful information.

We have been closely involved in this topic since the end of 2015. We started with Bitcoin, then worked with Ethereum.

Before this book was born, we lost hundreds of thousands of dollars on the two of us.

Maxim: «Before I started working with cryptocurrency, I was involved in different types of businesses — construction, catering, consulting. My path into crypto was not the easiest: once I lost all my investments. I bought Ripple after seeing how the market was gaining momentum, but then I lost almost 6 thousand dollars due to a rate hike. I quickly withdrew the rest of my funds and was extremely happy to have gotten my feet out of there. But this story, on the contrary, made me study the cryptocurrency market and its mechanics.

The most important lesson I learned after the first few years of working with cryptocurrencies is that there is no such thing as easy and fast money. To be an expert, you need to understand how the blockchain world works and what influences it. The biggest mistake beginners make is the desire to make money fast. No, it doesn’t work that way.

Over time, I began to understand it not at the level of an ordinary person, but at the level of a professional. The market is alive, it has its own dynamics. You need to know when it makes sense to enter it, and when you need to leave quickly.

If you are going into cryptocurrencies, I congratulate you. It’s a good decision. No matter what the skeptics say, Bloxxain is the technology of the future.

Once you start delving into this story, you will have a huge amount of knowledge on different subjects that you will then apply to your life. Working with cryptocurrencies, I started to understand how the media works, how it works, how news is manipulated. I can see what the future holds in smart contracts, in the future it will help formalize any transaction, from car leasing to real estate sales. It will help remove unnecessary middlemen.

Cryptocurrencies are good as a means of settlement. Imagine that all currency has run out, there are no rubles or dollars. But there is bitcoin or several cryptocurrencies. You can use them to pay with, to make exchanges, bypassing banks, bypassing expensive swifts.

You can keep savings in cryptocurrencies.

The more you know about crypto, the more you delve into this topic, understand, learn, the higher will be your value in the market as a specialist.

You don’t have to invest and build portfolios. Bitcoin can be used as a means of keeping savings.

There is a saying: first people laugh, then they shut up, then people have nowhere else to go. And this is characteristic of any new technology. People used to laugh when they bought pizza with bitcoins. When Facebook was first invented, no one thought it would grow from a student network into the biggest social network in the world. Don’t mind the ridicule, but you should definitely go into the world of Bloxxain with your head and take your time.

Vyacheslav: «I spent 10 years in the army, 5 years studying, 5 years serving in the Crimea. I got two higher educations and finished a lot of special courses, from analyst to courses on building sales departments. Then he quit his job and tried different jobs and businesses: trading, intermediary services, catering, consulting.

When I met Maxim, I already had an office. We consulted on various financial products. There were various partnership programs, we earned money as intermediaries, and we did quite well. How did we end up in crypto? We were developing our own cryptocurrency. Just in 2015, Ethereum had just appeared. We were leading the technical part of a project, and we needed an internal cryptocurrency for it. We were working with the Ambisafe team at the time, they had a great swing and were doing ICO projects on their own platform. Just with them they created a cryptocurrency that still exists somewhere.

In late 2015 and early 2016, my immersion into the world of cryptocurrencies began.

In January 2016, I bought 50 bitcoins (now and at the peak in prices in 2021, it was a huge amount), converted them to Ethereum and invested everything in the ICO of TheDAO project. It was the largest ICO that raised a lot of money, tens of millions. Ethereum alone was about 30—40% of the total amount. The ICO was very successful. But at one point it was hacked. After this story, Ethereum split into two currencies. The so-called Ethereum Classic appeared. That’s when I realized what it was like when all your funds were invested in one place, what it was like not to diversify them, but to just pour them all into one project. At that exchange rate this mistake cost me more than 10 thousand dollars. But if you recalculate it at the current Ethereum exchange rate (ed. — at the end of June 2023, the exchange rate is about $1900), it’s a colossal amount of money. I had about 1000 ETH, multiplied by $1900, and even at the current exchange rate it’s almost 2 million dollars!

But I was lucky, I managed to get the coins back and even some Ethereum Classic.

That information you will read in the book cost us hundreds of thousands of dollars. At the very least. And you get it for free. Or for symbolic money.

It’s up to you how you want to use it. Either way, good luck. We are sure you will never want to leave the path of conqueror of the Blockchain world.

Everything you will read in this book is the result of our experience, sometimes sad, sometimes successful. But absolutely we are not theorists, we are practitioners.

Everything we tell you about Bloxchain, Bitcoin, Ethereum, Ripple and other cryptocurrencies is tested on successful and unsuccessful transactions.

In addition to our own funds, we also manage portfolios. The volume of portfolios in different periods varies from 1,000,000 to 5,000,000 dollars.

For those who are especially advanced and motivated, there are recommendations from traders at the end of the book.

If you have the desire to learn and develop further, you can learn the profession of a broker in the cryptocurrency market and, due to your experience, flair and expert knowledge, advise others and manage other people’s assets.

I hope we’ve convinced you that we know a little more about cryptocurrencies than the average, run-of-the-mill citizen?»

Important information and disclaimer!

The authors of the book are not responsible for the content of the material from the sources mentioned in the book, for any damages or losses associated with any products or services mentioned in the book.

We encourage readers to do their own research about the product or service mentioned in the text with due diligence.

How to use this book?

You can read the whole thing from cover to cover if you are used to working thoughtfully and systematically with information.

You can start at the end. In the appendices you will find checklists for a beginner in the crypto market with a list of necessary actions. And also a small test that will help you understand what type of trader you belong to.

If you already know what Bloxxhain, Bitcoin, Ethereum are and how it all works, you can flip through the first chapters and read right from the part on portfolio formation and exchange trading.

The glossary of terms at the end of the book will help to structure the information and better understand the main material of the book.

In addition to the book, we invite you to subscribe to the accounts of the Pro Blockchain Media project in Telegram, YouTube, and Twitter.

If you have any questions or suggestions, we would be happy to hear from you.

Our contacts

Official website — https://pro-blockchain.com.

Academy — https://bitbrain.me/

Telegram — https://t.me/Pro_Blockchain

YouTube — http://www.youtube.com/c/PROBLOCKCHAIN

Twitter — https://twitter.com/PRO_BLOCKCHAIN

If you, like us, are fascinated by the world of cryptocurrencies and seek to enrich your knowledge in this exciting field, then we have a special surprise for you! We offer you to go to a special secret page of our cryptoacademy website bitbrain.me/secret_bonus, where you will find a huge amount of useful text and graphic materials.

Enter by QR code!

On this page, you’ll discover a treasure trove of valuable knowledge about cryptocurrencies, the latest industry trends, insider information, and more! Our team of experts has worked tirelessly to gather the most relevant and valuable information for you.

Don’t miss the opportunity to expand your horizons in the world of cryptocurrencies and investing. Go to our secret page right now and become a part of our crypto community, where knowledge is the key to success!

We look forward to seeing you at bitbrain.me/secret_bonus. Unlock the potential of cryptocurrencies with us!

Part 1.

Blockchain and cryptocurrencies.

What are they and how to handle them?

Cryptocurrency is

21st century money

This industry is a newcomer among other types of economies, businesses, and human hobbies. It was in 2008 that bitcoin.org was officially registered and the first coins appeared.

However, as much hype as appeared around the crypto from the very first years of its existence, perhaps, was not with any other instrument in the field of finance and mutual settlements.

If you look into the essence of the term, its roots go back to the Greek language. Translated from the language of Antiquity (Greek) kryptos means «secret, hidden». Cryptocurrencies work thanks to data encryption technology, or cryptography.

Distinguishing characteristics of cryptocurrencies:

• decentralized data that is stored on multiple computers at the same time;

• anonymity (you don’t know who transferred money to you, you don’t know who owns the wallet where you transfer money);

• security (the record of the transaction cannot be forged or changed).

We believe that cryptocurrencies are the new generation of assets that will change our lives.

Although there are still many skeptics who believe that the value of bitcoin and other coins is exaggerated, that their rate will sooner or later collapse, that this money is useless…

This is normal resistance to the new. Once people did not believe in bank cards and were afraid of ATMs. Once upon a time, a smartphone with its simple functions seemed like science fiction. But a little more time will pass — and cryptocurrencies will become a familiar means of payment for all segments of the population.

This book, among other things, will help you understand the essence of new money, learn how to handle them and not lose your blood fiat money on cryptocurrency transactions. But about that next…

The revolutionary feature of cryptocurrencies is that transactions take place directly between users, without the involvement of anyone else.

For example, if you want to order a memory card for your phone or a trendy t-shirt on Aliexpress, you will need a bank card to pay for it. Thus, there is an intermediary between you and the online store — the bank. Soon Aliexpress and other monsters of online commerce will accept crypto-money on par with bank cards, Webmoney and PayPal.

The basis for the development of cryptocurrencies was the invention of blockchain technology (Blockchain).

Blockchain, or «block chain» in English, is a system of distributed information storage. In the Blockchain system there is no single server where the entire database is stored, information can be simultaneously recorded on several devices.

All data in the Blockchain network is recorded in blocks that are linked to each other.

All transactions take place in the blockchain. Each transaction is written to a block and cannot be changed anymore. In order to form a new block, certain calculations must be done. That computer, which has managed to do the task, receives its reward in bitcoins. This process is called mining, and accordingly, the owners of the computers that do the calculations are miners.

The more miners there are in the world, the faster the transactions can go and the more stable the whole system is.

What is Bitcoin? It is essentially the name of a network that began operating in 2009 and which utilized Blockchain technology.

To break these concepts down, let’s define it once again:

Blockchain is a technology that can be applied to more than just cryptocurrencies; bitcoin is a cryptocurrency, the first cryptocurrency, the progenitor of all other coins and by far the most valuable of currencies.

The term «cryptocurrency» gained traction in 2011 thanks to a Forbes magazine article on Bitcoin. Subsequently, the term «cryptocurrency» began to refer to any crypto-money.

The word Bitcoin is formed from two English words: bit — unit of information and coin — coin. The literal translation into Russian is «minimal coin».

It is the first most expensive and has the largest capitalization today cryptocurrency.

The purpose of bitcoin is to create a universal global decentralized payment system that is not under the control of banks, governments and other intermediaries. Bitcoin, like other cryptocurrencies, helps to make p2p (person to person) payments.

The pros of bitcoin compared to traditional (fiat) currencies are:

● A bitcoin account can never be blocked by anyone. These are your funds forever. Only on the condition that you follow digital security techniques. We’ll talk more about security techniques later. And more than once.

● Account transactions are both anonymous and transparent. The list of transactions can be tracked in a publicly available log. It is not known who sent the money and to whom.

Unlike a classic bank account, a cryptocurrency account is not tied to personal data.

But not everything is so rosy. Bitcoin and other cryptocurrencies also have disadvantages:

● If you make a mistake with your wallet number (it’s not hard to make a mistake here — the ID of each wallet consists of 34 characters, including numbers, lowercase and uppercase letters and other characters), it will be impossible to cancel the transaction. Attention and thoroughness are the keys to success in working with cryptocurrency.

The cryptocurrency market is highly volatile due to its rapid growth and the nature of cryptocurrencies themselves. (Volatility is the level of price changes in the market. High volatility is when the price can change significantly in a short period of time). This is why inexperienced and novice crypto traders lose money, because it is very difficult to predict how the market will behave in the coming months.

If your wallet has been hacked or lost, if you have forgotten the password or passphrase of your wallet, it is impossible to get back the lost funds.

How is blockchain better than a database?

This question was answered comprehensively and succinctly by Matthew Chan, entrepreneur, designer, cryptocurrency enthusiast, and creator of MatrixPortfolio.com, a mobile app for crypto investors.

The original article was published on Hacker Noon, translation on our portal https://pro-blockchain.com.

I want to convince you why blockchain is necessary, why we need to motivate people to pursue decentralization and its benefits, and why tokens are needed and what underlies their value. Now that the cryptocurrency market is increasingly saturated, it is important for us to understand the underlying technologies and principles behind digital money, as this understanding will allow us to make smart investments and separate the important from the non-essential.

In fact, blockchain borrows a lot from game theory and motivational models. For a blockchain network to be valuable and/or useful, it must have participants. It will be useless if only you and I are blockchain users.

In order to attract participants, some form of motivation is required. The most common means of motivation is a reward in the form of a token. The more participants there are, the more decentralized the network becomes.

Why not just a database? Why do projects need blockchain?

A decentralized system has several advantages over a centralized server / database:

● immutability;

● security;

● backup;

● cost reduction;

● accountability and transparency.

Immutability

When data and records are decentralized and hosted on a blockchain, they are virtually impossible to falsify or change. If you store data on, say, a personal computer, you can easily alter a file before sending it to another person. How can you be trusted in this case?

Security

Traditional servers or data tend to be centralized, making them an attractive target for attacks. The Equifax security breaches and other recent cybersecurity issues are a case in point. A single server or a limited number of servers can easily fall victim to hackers, but decentralization through blockchain puts a serious damper on attackers. The more participants and nodes in the network, the more copies of data exist. Therefore, in order to modify data, it is necessary to attack every single node in the network and modify all the data at the same time. Blockchain not only serves as a defense against theft, but it has virtually no vulnerabilities. Each block on the chain contains a certain amount of data, and when that block gets full, like a USB flash drive, the data is encrypted and sealed forever. To get the whole picture, hackers would need to hack not only the current block, but every block preceding it. Not only is this nearly impossible technically, but it is also expensive. Thus, the incentive for criminal activity is reduced. I am now describing the concept in general: different blockchains use different security measures and algorithms.

Backup

If the dataset is distributed globally, you don’t have to worry about losing a single copy. Thanks to this, you can protect against corporations getting rid of data tampering, server failures, etc.

Cost reduction

A decentralized network of nodes supporting a registry helps companies reduce hosting, security and maintenance costs. In addition, decentralization saves on salaries for IT professionals, developers, and infrastructure managers. For example, Apple’s servers are literally under constant attack, forcing teams to monitor them 24 hours a day, 365 days a year.

Accountability and transparency

With the above in mind, you can rest assured that all information recorded on the blockchain is authentic. This allows one to do business in a transparent manner, freeing one from having to trust the opposite party. One can always turn to the blockchain, letting the data and facts speak for themselves.

Are today’s data infrastructures workable? Undoubtedly, but they are far from perfect. They worked as well as they could because there was no blockchain, a technology that enables significant improvements.

Okay, but what gives tokens value? Why are they in demand?

It depends on the project. 90% of all projects are worthless, but we’re going to talk about tokens that have real value and are actually applicable.

As I mentioned earlier, tokens are often used as a means of motivating network participants: a successful network implies many participants contributing to its decentralization and protection. The more participants there are, the more the network benefits. This is precisely the case of bitcoin. When Satoshi introduced it to the world, bitcoin had zero value. At that time, the only participant in the network was Satoshi himself. But now, as bitcoin becomes more widespread, people increasingly agree that the bitcoin token is useful as a currency and therefore has intrinsic value to the participants in the network.

In general, there are several classes of tokens, and each class has its own specific value.

Currency tokens: Bitcoin, Monero, Raiblocks, etc.

Utility tokens (utility tokens), which allow to perform some activity in the network, examples are ETH and ZRX. In the etherium network, ether is used for smart contracts.

Asset tokens, representing an actual asset or product.

Equity tokens (equity tokens), which function as securities. They give the right to vote and participate in decision-making.

The value of currency tokens, such as bitcoin, is determined primarily by their ability to function as currency and a store of value.

The value of service tokens is determined by the popularity and usefulness of the network: for example, the amount of data that is hosted on the blockchain and the amount of information that is processed, as there are parties willing to pay fees for processing, validation, transmission and protection of data. These could be decentralized exchanges or companies hosting supply chain data on the blockchain, etc.

Asset tokens can be linked to the value of the real assets they represent.

Asset tokens can be valued based on investor sentiment and the progress of the project itself. What plays a role here is whether they are used in commerce and accepted by the real world, what voting rights their holders have, the potential and direction of the company, etc.

So what influences the price of tokens?

Now that we know what the source of value of tokens is, it’s time to ask this question.

Different projects and tokens may have different incentives or economic models that affect the price. Speculation aside, there are certain technical factors that affect the price regardless of investor sentiment.

Demand and consumption. This is likely the most significant factor in the question of token value, especially these days when the market is purely speculative in nature.

Popularity/utility. This factor has to do with answering the questions of whether there is any activity on the network and how widespread the token is.

Burn rate. Do tokens lose value over time? At what rate?

Circulation and reserves. How many tokens are in circulation? Is there an «untouchable reserve»?

Generation of secondary tokens (such as NEO/GAS, etc.).

Mining/premining. How many coins have already been released and what is the release schedule? Or have they all been mined already?

Satoshi Nakamoto — human or artificial intelligence?

Satoshi Nakamoto is considered to be the creator of Bloxxhain and Bitcoin technology. Until now, no one knows whether it is one person, a group of programmers or artificial intelligence.

There are a lot of facts, rumors around this name. There were several attempts to find out who is hiding behind this name, but they were unsuccessful.

According to one version, Satoshi Nakamoto is from Japan, but currently lives in the northeastern United States. Periodically, someone tries to catch the hype on Satoshi’s name and declares himself to be him. In the US, journalist Leah Goodman spent months investigating and looking for traces of Satoshi. She eventually managed to find a man of Japanese descent named Dorian Satoshi Nakamoto. However, the accidental namesake of the genius of the cryptoworld himself admitted that he had never heard anything about bitcoins.

Periodically, the media published articles proving that under the name of Nakamoto hides professor of economics Nick Sabo (Sobo), a mathematician from Japan Motizuki Shinite, the owner of crypto exchanges Ross Ulbricht and many others. The press also suggested that Nakamoto is Ilon Musk.

However, all these investigations remained only versions, not supported by reliable facts. The Satoshi candidates themselves deny their involvement in the creation of blockchain and bitcoin.

What do we know about Satoshi Nakamoto now? It is known that he owns almost one million bitcoins, making him one of the richest people in the world. In 2008, when blockchain came into existence, he was 37 years old.

As of 2010, Satoshi Nakamoto has officially stepped aside. No new publications or statements signed with that name have appeared again.

Technically, when bitcoin was created, there was a limit of 21 million coins. Satoshi also stipulated this rule.

If Satoshi Nakamoto decides to sell all his bitcoins at once, it will crash the cryptocurrency market and devalue bitcoin to almost zero.

Hopefully this won’t happen in the near future, bitcoin will remain the flagship of cryptocurrencies and what helps the whole system balance.

Is it possible to touch cryptocurrency?

Bitcoin and any other currency cannot be touched in person, nor are they minted by any mint in the world.

Although the most widespread and stable cryptocurrencies have their own symbols, on par with the dollar ($), pound (£), euro (€), ruble, and so on.

Bitcoin and other cryptocurrencies exist only in virtual reality. That said, they can be exchanged for real money.

Another difference between crypto and fiat money is that they arise themselves in the digital space. And anyone can produce (mine) bitcoin. No central bank or state is needed for this.

Cryptocurrencies appear through ICO (investment), as a result of mining (maintenance of special servers) and forging (forging) — the formation of new blocks (branches) in already existing digital currencies.

Nevertheless, today bitcoin and other currencies are quite realistically turning into living money — into houses, apartments, trips, yachts and other pleasures.

By the way, in the first year of Bitcoin’s creation, a legendary transaction was realized — the first purchase of real goods for cryptocurrency. For 10,000 bitcoins were bought two pizzas totaling $41.

So «wastefully» spent his savings American programmer Laszlo Hanyecz (Laszlo Hanyecz). The thread on the forum is still available at the link — https://bitcointalk.org/index.php?topic=137.0.

Now convert that to the current exchange rate and grab your head. Today (July 2023 — ed.) 10,000 bitcoins are equivalent to $300 million US dollars, and the total capitalization of all cryptocurrencies is $1.2 trillion.

The most popular types of cryptocurrencies

According to https://coinmarketcap.com/, in July 2023, there are more than 10,000 cryptocurrencies registered in the world.

Of course, their value varies. And the fate of most small coins can turn out any way you want. Some coins will take off, some will disappear from the lists of exchanges. But nevertheless, the fact remains that blockchain technology allows you to create an unlimited number of types of crypto-money, the capitalization of which, depending on the exchange rate of major currencies (Bitcoin, Ethereum, etc.), the total approaching $ 300 billion (at the time of writing this material — this price is always fluctuating).

At the same time, the cryptocurrency market is characterized by high volatility. And this means strong fluctuations in the rate. In a matter of days, or even hours, the same bitcoin can collapse by several hundred dollars, and may even grow.

Hence, the potential of each new moment is quite high. It can grow by 50, 100 and even 1000 times. This is what makes it possible to move crypto markets and make money from them.

Each type of cryptocurrency has its own pros and cons, its own value and its own potential for growth.

But collectively:

● they are all universal,

● they can be exchanged for either other cryptocurrencies or fiat money,

● they can be saved,

● they can be used to pay for goods and services,

● their exchange rate is subject to supply and demand.

What are the most popular currencies today? Whose capitalization (the total value of all issued cryptocurrency coins) exceeds a billion dollars?

So far, the top 10 looks like this (data as of July 2023):

• Bitcoin.

• Ethereum.

• Tether.

• BNB.

• USD Coin.

• XRP.

• Cardano.

• Dogecoin.

• Solana.

• TRON.

Bitcoin (BTC) is the first and most widespread digital currency. All subsequent ones appeared on its basis.

Ethereum — the authorship of the currency is attributed to Vitalik Buterin. It is one of the most popular cryptocurrencies.

Tether is a cryptocurrency token issued by Tether Limited, which claims that its value is 80 percent provided by the stock of U.S. dollars in bank accounts or its equivalent. The main idea of the developers of this token is to provide cryptocurrency market participants with an opportunity to use a stable digital asset steyblocoin, the rate of which is tied to the U.S. dollar exchange rate and does not experience such strong fluctuations as the rates of other cryptocurrencies. Tether is issued on the Omni Layer platform, which is an add-on to the bitcoin blockchain.

Cardano is a decentralized public cryptocurrency project, a third-generation platform developed in the Haskell programming language. The project solves the problem of fast and cheap creation of decentralized applications and smart contracts in a secure and scalable way. It entered the market in 2015.

Is it easy to work on the cryptocurrency market?

The purpose of this book is to tell beginners about the crypto market and show that anyone can earn money in crypto. You don’t need to have any special education for this, you don’t need to buy a super-powerful computer for this.

You don’t need a lot of money to start working with cryptocurrency. Your first investment can start from 100 dollars.

Judging by these criteria, yes, it is easy to work on the market.

If you come just to play and then, after losing money, come out disappointed.

However, there can be another way. It is easy to work on the market, but you need to be patient and invest your time in learning and studying the rules of the game.

But first, decide: for what purposes do you need cryptocurrency, what do you plan to do on the market? In general, it is useful to define your goals every time you plan something new in your life.

What can be the goals when working with crypto?

The goal is to save your own funds. To save them from inflation and denomination by the state. To do this, you can make a portfolio of the top 5 leading cryptocurrencies and not worry when bitcoin suddenly goes down.

The goal is to make a quick buck on cryptocurrency. This goal is both realistic and quite risky. Why? The market is alive, it has high volatility, the situation on it can change in a matter of hours, for this you need to constantly keep your hand on the pulse and review the portfolio of coins every day. One should also know the mathematical laws, according to which one should invest in a particular currency. The chances that a particular coin will take off a few dozen times are small. It’s like winning the lottery. Will you be lucky or unlucky? We answer: the lucky one is the one who enters the market professionally and makes a portfolio professionally. In this case «quickly» can be from half a year to a year. Not a month, for example, as some inexperienced hamsters dream about it.

The goal is to become a trader and manage other people’s portfolios. This is an excellent goal, it allows you not to spend your own money, but to take other people’s assets under management at once. However, before going into consulting and portfolio management, you need experience and successful cases.

Goals may change, and that’s okay. You may want to become a trader, realize that it is not for you, but leave some assets in bitcoins and ethers just in case. Or you will enter the market cautiously to have a look around, but in time you will get involved and learn a new profession.

They say that to become an ace, a pilot needs to fly an airplane for 10,000 hours. It may take less time to become an ace at cryptocurrencies, but at a minimum, it will take you a few weeks or even months to begin to understand market movements, keep your finger on the pulse, and see how media reports and tweets can move the market.

Your advantage over where we were three years ago is that you will gain a lot of knowledge many times faster than we did. Good luck!

Where can I find information on cryptocurrencies fast?

Do you want to be a successful crypto trader and react quickly to all market movements?

The first and most important skill you should acquire when working with cryptocurrency is the skill of working with information.

To work with information is to be able to search, analyze, study and record everything that is related directly or indirectly to your topic.

It is also the ability to check the information you see for validity.

The criteria important for evaluating any incoming information are: credibility, timeliness, and reliability of the source.

In the world of crypto-money, decisions need to be made quickly, and there are times when the situation with coin rates changes in a matter of hours. One careless tweet can both help a coin to take off and drop it.

!Our advice! Follow the official Twitter accounts for each cryptocurrency. Do not wait for this information to be processed by the media, translated into Russian and disseminated.

Where to get data on official websites, Twitter accounts and other important news?

First of all, we recommend that you bookmark https://coinmarketcap.com/

This is a portal that accumulates all the information on the existing cryptocurrencies in the world.

Here you can see in dynamics, at what rate coins are offered, how many coins are actually on the market now, on which exchanges they are traded.

The site is convenient because there is a Russian version, it has a clear interface, and for each coin you can get comprehensive information: cost, dynamics, links to official sites, Twitter, etc.

Official sites for the most popular coins:

Bitcoin — https://bitcoin.org/ru/.

Ethereum — https://www.ethereum.org/.

Cryptocurrency forum — https://bitcointalk.org/.

Pro Blockchain Media Project

YouTube — http://www.youtube.com/c/PROBLOCKCHAIN

Website — https://pro-blockchain.com/

Telegram — https://t.me/Pro_Blockchain

VK — https://vk.com/problockchain

Twitter — https://twitter.com/PRO_BLOCKCHAIN

Important: To avoid phishing attacks, pay attention to the spelling of the site name and whether it has an SSL certificate.

First steps in the world of cryptocurrencies

1. Creating an email on Google

If you are young enough, used to communicate via social networks and messengers and consider email something archaic and old-school, you will still need it when mastering Blockchain.

The best way to create an e-mail account is to use Google. You should not use mail.ru, yandex.ru and other portals.

Mail with the domain gmail.com is the safest today. You’d better register a new box, separate from other tasks, only for working with crypto.

2. Create a strong password

To create a password, it is best to use a password generator.

For example, the service: http://www.onlinepasswordgenerator.ru/.

Here you can set the password parameters: number of characters, lowercase, uppercase letters, etc.

Clicking the «Generate» button will give you a choice of 10 strong passwords that are difficult to crack.

More password generator options:

https://randstuff.ru/password/

Choose any of them and remember security at all times.

Save the generated password in a safe place. Periodically change the password on your mailbox.

It is desirable to use different passwords for different services.

3. Installing Google Authenticator

This is a special application that you put on your phone — «Android» or iOS, it is tied directly to your account, it can be tied to the exchange, mail, other services related to cryptocurrency, and so on.

You should definitely use it! It will be an additional protection of your mail and further access to those passwords that you have.

Using it is very simple.

In the settings of your gmail.com mail in the section «Accounts and Import» — «Change Settings» — «Password Recovery» there will be a tab «Two-step authentication». You select the Google tab. Then you’ll have a QR code, you scan it with your phone and a pre-downloaded app.

The program generates a new code every 30 seconds, so you’ll have to enter your username, password, and this code when you log into your email. It’s somewhat similar to two-factor authentication via SMS passwords, only in this case you get a second password through the Google app.

You can have multiple passwords here: for different exchanges, email, different wallets, etc.

This is an extremely useful thing that you should definitely take advantage of.

Don’t neglect your own security, otherwise you will lose your own or, even worse, someone else’s assets in an instant.

Part 2.

Crypto wallets

When man invented money as an equivalent of goods and services, at first it was simply kept in pockets, then wallets, sacks, chests, kegs and other containers appeared.

But, as you can see for yourself, gold coins or bills can be in circulation by themselves. Digital money, which in reality cannot be touched or tasted, cannot exist without wallets.

Basically, what is a digital wallet? It is a program or an encrypted and secure record of your account.

The program can be installed on your computer’s hard drive or on your smartphone. To conduct transactions, the program on the Bloxxhain network confirms its legitimacy and enters the transaction data into a registry.

We have already on the pages of this book talked about security and all the precautions you need to take when working with cryptocurrency.

Remember that the principle «don’t put all your eggs in one basket» is more relevant here than ever. It is desirable to distribute all your digital assets in different wallets, as force majeure, hackers’ attacks, your inattention can significantly empty your cryptocurrency account if it exists only in one place and only bitcoins are stored on it.

Where is cryptocurrency stored? Or the main types of wallets

According to the method of communication with the Blockchain system, wallets are divided into hot wallets (hot storage) and cold wallets (cold storage).

A hot wallet is usually downloaded to a computer or mobile device. These programs maintain a constant connection with the system, which allows all transactions to be carried out quickly. When there is no heavy load on the network, then even at the basic tariff (minimum commission to miners), the money goes a few minutes.

This type of wallet is vulnerable to hackers. Therefore, do not forget about security techniques, which you have already familiarized yourself with in the previous chapter.

This is a complex password, two-factor authentication and a 12-word code that you should memorize and keep in a safe place.

Remember: if you forget the code, you will lose all your savings on this wallet irrevocably.

In contrast to the hot wallet — cold wallet (cold wallet), due to the lack of constant connection with the network is better protected from hackers. This type of wallet is more suitable for storing savings. It is necessary to keep the key for access to the wallet on a separate carrier, which helps to avoid hacking.

A cold wallet is usually a piece of paper with keys printed on it — public and private.

The public key is the address to which you can send money. It looks like a set of symbols or a QR code. But you also have a private key, which allows you to withdraw money from your wallet.

Just in case we repeat once again: wallet keys should be guarded like the apple of your eye, because it will be impossible to recover them later.

By the way, according to various estimates, about 20% of keys are lost in the world now. Thus, the currency stored in wallets with lost keys is blocked. There is no access to it. This situation creates some scarcity (and you and I remember that the number of bitcoins is finite) and the ability to keep bitcoin at a fairly high level in terms of price.

Hardware wallets

Hardware wallets are compact gadgets for storing cryptocurrencies. A high degree of security is achieved due to the fact that private access keys are stored encrypted on this device. Several levels of protection, including pin code, make it as reliable as a safe in a Swiss bank.

The most popular hardware wallets are Ledger Nano, Trezor.

Let’s dwell on them in detail.

Trezor is used to store bitcoin. When installing the wallet, it will offer you a unique 24-word security key. It must be written down. If you lose the key, it will be impossible to access your funds.

In addition, Trezor offers to come up with a pin code. Pin-code is created without connecting to the Internet, so no one can intercept this password.

Be careful when entering the pin-code. Each mistake freezes the wallet, and the more you make mistakes, the longer the blocking is activated.

Another level of protection is a keyword. The same word will be requested when restoring the wallet after loss or breakage. Without the keyword there will be no access to the wallet.

The wallet has a display that shows where the money is sent. And to confirm each action you need to press the buttons, which eliminates the possibility of hacking it.

Another family of hardware wallets is Ledger.

They are not inferior to Trezor in the level of protection, quality of work. There are versions of wallets with and without displays.

Ledger Nano S is a model with a display. It also has two confirmation buttons that require physical pressing (which, like Trezor wallet, protects from malware attacks). To open the wallet, you also need to come up with a four-digit pin code. There is also a code phrase of 24 words, which will be requested when trying to make a transaction from the wallet. It is important to remember that if you enter the pin code incorrectly three times, the wallet is blocked.

So, the market offers a lot of hardware wallets, and their prices are quite affordable. You can try any wallet that seems reliable to you. The main thing is to remember about security! If you order a wallet on the Internet, make sure that it came whole, not opened. There are known cases when attackers put malware on the gadget, which then «took» money from the account.

Hardware wallets are needed mainly for long-term storage of cryptocurrencies.

Cryptocurrency exchanges

In the world today there is a huge number of exchanges that trade in cryptocurrencies. What is the convenience of the exchange? All work is done online through a browser, there is no need to use a hardware wallet or wallet in the form of an application.

Cryptocurrency exchanges typically support a wide range of cryptocurrencies, including popular cryptocurrencies such as Bitcoin (BTC) and Ethereum (ETH), as well as many other altcoins.

Exchanges offer various trading pairs that determine which cryptocurrencies can be exchanged between each other. For example, an exchange may offer to trade Bitcoin for Ethereum or Bitcoin for USDT.

You can fund your account on the exchange in bitcoin, Ethereum, and other altcoins. There are exchanges where you can use both regular bank cards and traditional electronic wallets (WebMoney, etc.).

Cryptocurrency exchange https://partner.bybit.com/b/problockchain supports different deposit systems, including fiat (regular money like USD$) The CEX exchange supports bank cards.

The most popular exchanges in 2023.

Please note that the rating may change depending on current trading volumes.

Binance is the most popular and large-scale exchange in the crypto world with an average daily turnover of $30 billion. The platform has a convenient multi-lingual interface, a large number of trading pairs. Mandatory verification of identity.

Bybit is a futures platform with support for copy-trading inverse contracts and other useful options. Here you can work on the spot marketplace and P2P, use leveraged tokens and a trading bot. An NFT marketplace is open for digital art lovers. A non-custodial DEX platform and Bybit Wallet with Dapp support have been launched.

HUOBI is a resource with a large set of trading tools and a unique system of protection against hacking. It supports leveraged trading on spot and futures, as well as staking, including ETH 2.0, free trading bot and OTC transactions. You can mine 7 digital assets on the mining pool. You can exchange crypto for fiat in the «Quick Buy/Sell» tab or on the P2P marketplace. In the «Training» section there are many useful articles for beginners, but you will have to translate them into Russian yourself. Bonus from the authors of the book! Register on the exchange and get 10% discount on commissions and $700 bonuses — https://bit.ly/3bsh6pf.

MEXC Global is a rather popular Asian exchange that offers many tools for working with cryptocurrency derivatives and tokens of defi-projects. You can trade with margin on the spot market, join the MX-Defi mining pool, get prizes for exchanging select tokens or trading M-Day futures. The exchange supports P2P trading and its own MasterCard MEXC plastic card, the balance of which can be topped up with cryptocurrency. Copytrading, a free trading bot and other trading tools are available. You can trade on the exchange without verification, but not all sections will be available. After passing the basic KYC level, you can trade on P2P with the Russian ruble.

KUCOIN is a simple and convenient exchange for cryptocurrency trading and staking. If you are satisfied with the daily withdrawal limit of 5 BTC, you can trade anonymously. For verified customers, the withdrawal limit goes up to 200 BTC and the leverage for futures trading goes up to 100x. You can buy digital currency with a credit card and in the P2P section.

Bitget is a trading platform that has been operating since 2018. It is designed for spot, futures and coin trading. The digital assets are bitcoin, lightcoin, etherium, etc. Trading is organized on a proprietary terminal. There is an official website of the Bitget exchange, a mobile application for iOS and Android. The maker’s commission is 0.02%, the taker’s — 0.06%, there is also a special program for vip-clients with reduced commissions.

The company is headquartered in Singapore. Bitget cryptocurrency exchange is one of the fastest growing exchanges. The total number of users has almost doubled over the last year and already exceeds 8 million.

EXMO — attracts residents of Eastern Europe with the opportunity to exchange cryptocurrency for local currencies Russian ruble, Ukrainian hryvnia, Polish zloty, Turkish lira. And, of course, there are trading pairs with the U.S. dollar and euro. Merchant service is supported, which allows businessmen to accept payment for goods and services with digital money, as well as OTC transactions and trading with the help of cross-platform trading bots.

Okex, or OKX, is one of the safest crypto exchanges with an extensive set of trading tools and user-friendly interface. The service is constantly expanding its services, providing traders with additional opportunities to earn money. In 2022, the exchange rebranded and changed its name from Okex to OKX. Innovations will improve the performance of a variety of tasks, as well as contribute to the expansion of functional capabilities. Beginners are provided with a demo account. It is possible to trade with margin on the spot and futures market, earn passive income on crypto loans and work on a pool. In the Exchange Cloud section, everyone can try to create their own crypto exchange from scratch, customize branding for different web platforms and applications.

Garantex is an exchange for exchanging BTC/USDT to RUB. Transactions are conducted through a single exchange glass BTC/USDT — RUB with automatic conversion. The exchange works with BTC, USDT-ERC20, USDT-OMNI. Simple registration, account protection with double authorization, minimum interest per transaction (0.1%), direct interaction with clients from Moscow, St. Petersburg, Krasnodar, Rostov and Yekaterinburg. Transactions on the platform can be made around the clock. The Garantex exchange is designed for traders, miners and even exchangers. For miners, the highest buying rate is guaranteed, and the official website of the exchange offers to get cash at the cash desk, by courier or by withdrawal to a bank card. There is also an affiliate program on the exchange, according to which you will receive 0.1% of all transactions of your invited participants. Recently, the exchange has created new ruble codes, with the help of which you can transfer funds to other users of the exchange Garantex. But the main plus is that there is an opportunity to sell codes, earning up to 1.5% of the code amount. For beginners there is a simplified system of selling codes. Don’t miss your chance to earn.

Yobit is a popular service among miners and crypto traders. Its main advantages: the ability to exchange cryptocurrency for rubles and US dollars; complete anonymity, no identity verification, support for little-known blockchain projects. Yobit trading platform works with a thousand altcoins and provides active customers with a bonus in the form of access to the money faucet.

What to pay attention to when choosing a trading platform?

The choice of platform depends on the digital assets used. The most popular currencies are traded on all exchanges, but little-known altcoins may not be on all services.

When choosing an exchange, study the reviews. You can visit resources such as Bitcointalk, Reddit or miningclub.info.

Pay attention to the prices of the coin you are interested in on a particular trading platform. Most coins are exchanged for bitcoin, less often for etherium, lightcoin or other alts. The cost of the exchange is expressed in dollars and it can vary slightly from exchange to exchange.

Gather information about the commission fee. Each exchange has its own conditions. It is also important to pay attention to the minimum amount of deposit and withdrawal.

Large crypto exchanges often require verification of identity. If this is not done, the conditions for withdrawal and trading may be less favorable. If you do not want to undergo verification, then study the client agreement.

Pay attention to whether the exchange supports transactions with fiat currencies.

For those who are engaged in trading, a convenient interface and options for technical and graphical analysis are important.

Choice of trading instruments. On some exchanges you can buy or sell coins only at the current price. Other sites allow you to create stop-limit and other types of orders, the price of which is specified by the user.

After the introduction of economic sanctions against the Russian Federation by Western countries, Russians trading on crypto exchanges have another headache. Some platforms have started restricting the access of Russians to trading and even blocking their accounts. Some «especially advanced» exchanges have put citizens of Russia and Belarus and all residents of the recently annexed territories on the persona non grata lists, along with citizens of Afghanistan and other countries that are not quite as prosperous. Our list includes exchanges that work with citizens of the Russian Federation.

It is not always possible to work only on one crypto platform. Most miners and traders have 2—3 accounts on different services, switching between them depending on the situation on the market as a whole, and on each of the trading platforms separately.

Minuses of working on exchanges: high risk of account hacking, closure of exchanges by regulators, hacker attacks.

We have analyzed only a few examples of popular cryptocurrency exchanges, but the market is constantly changing, and new exchanges may appear. Each exchange has its own characteristics, and traders should do their own research to find the most suitable one for their needs.

How and where to buy cryptocurrencies bypassing exchanges

Sky Crypto

SKY CRYPTO is a large P2P platform that unites buyers and sellers from all over the world in a safe space to exchange and store cryptocurrency in an internal account. The service is available on any device: you can use the wallet on your PC in a web browser, Telegram bot and mobile app.

On the company’s website, prompt buying or selling of digital assets between clients is available. Users can exchange BTC, ETH and USDT on the site itself or via Telegram messenger.

The system has fixed commissions — 0.5% when selling and 1% when buying via the web platform or chatbot. At the same time, users are not charged fees when transferring assets within the SKY CRYPTO system. The site offers more than 30 payment methods.

The system does not require users to register, which allows customers to remain anonymous. To conduct a transaction, you need to specify only your e-mail address and details.

Sky Crypto Telegram Bots

As previously mentioned, you can buy and sell cryptocurrency in the Sky Crypto service via Telegram bots.

Sky Crypto has three official bots for each of the cryptocurrencies:

• Sky BTC Banker;

• Sky USDT Banker;

• Sky ETH Banker.

The advantages of using Telegram bots from Sky Crypto are:

Ease of use;

Cryptocurrency transfers directly to Telegram;

Sky Crypto Cryptocurrency wallet in Telegram, which is always at your fingertips;

Protection of each transaction by SKY-bot.

The Wallet by SKY CRYPTO mobile app is a reliable cryptocurrency wallet for storage and transfers, as well as a BTC, ETH and USDT exchanger. You can quickly deposit and withdraw Bitcoin, Tether and Ethereum, as well as fiat currencies.

A number of advantages that the app has:

• Full control and flexibility. Users of the platform can manage their crypto assets anytime and anywhere. Send and receive payments, track balances and transaction history with ease thanks to the intuitive interface of the Sky Crypto app.

• Security comes first. Sky Crypto uses advanced encryption technologies and multi-layered security measures to protect your crypto assets from unauthorized access.

• Ease of use. The app is designed so that even those new to the world of cryptocurrencies can easily navigate and start using it without difficulty.

A large P2P marketplace that brings together buyers and sellers from around the world in a safe space to exchange and store cryptocurrency in an internal account. The service is available on any device: you can use the wallet on your PC in a web browser, Telegram bot and mobile app.

Bestchange

Free service that helps to find exchange offices with the best exchange rates, calculator and detailed statistics on rates and reserves. BestChange.ru service has been continuously developing since 2007 and is the leader among exchange offices monitoring. Now you don’t need to go through a sea of bookmarks with addresses of exchangers — it is enough to have one, which will replace all the others — www.bestchange.ru.

Mono and multi-currency wallets

According to the number of supported coins, wallets are divided into mono-wallets and multi-currency wallets.

Mono wallets, as it is already clear from the name, store only one type of currency. As a rule, it is quite powerful, well-protected software. When working with such a wallet, a large amount of data is downloaded to your computer or phone. These wallets require a lot of disk space, they constantly need to be synchronized.

Agree, this is not very convenient for constant work. However, this is one of the most reliable ways to store crypto. Especially if you have a separate laptop with different degrees of protection under your monocurrency wallet, for which no one but you will no longer work.

Multi-currency wallets support several popular currencies. What is a multi-currency wallet? Basically, it is an interface for managing your funds.

Usually these are the most popular and popular coins from the top 10 or top 15. Wallet developers are constantly adding new coins to them. Some wallets, such as Jaxx, already have a built-in Shape Shift exchanger. And so right in it you can convert major currencies: Bitcoin, Bitcoin cash, Ethereum, Ethereum classic, Litecoin.

Jaxx can be installed on your smartphone, and you can also log in via the web interface. However, there are reports that the web version has insecure keys. We recommend using the mobile version of this wallet.

Not bad wallets are Coinomi, Exodus. They have almost all the same features as Jaxx.

TRUST WALLET multi-currency wallet

Trust Wallet is a mobile wallet for cryptocurrencies that supports more than 40 blockchains. The main feature of this wallet is that the wallet keys are stored directly on the user’s device rather than on a remote server, which significantly increases the security of storing funds.

Trust Wallet was created in 2017 by a team of developers led by Viktor Radchenko. In 2018, the company was acquired by Binance, one of the largest cryptocurrency exchanges in the world.

The main features of Trust Wallet include support for major cryptocurrencies such as Bitcoin, Ethereum, Litecoin and others, as well as support for ERC20 and ERC721 standard tokens. In addition, Trust Wallet allows users to interact with decentralized applications (DApps) right inside the wallet, as well as participate in the staking of some cryptocurrencies.

An example of using Trust Wallet:

1. Download and install the Trust Wallet app on your smartphone.

2. The first time you launch the app, you will be prompted to create a new wallet. Follow the on-screen instructions to complete the wallet creation process.

3. Once your wallet is created, you can start sending and receiving cryptocurrency. To do this, you will need your wallet address. You can find it by clicking on the name of the cryptocurrency in the list of your assets.

Бесплатный фрагмент закончился.

Купите книгу, чтобы продолжить чтение.