Бесплатный фрагмент - Fascinating economy

Chapter 1

You may never have thought of it this way, but in some ways, economics is like a game. Games have players and rules. Games involve decisions and actions, and they always have a goal. The same is true about economics.

Still, there are some differences. In games, you typically get to decide whether you want to play. But no one ever asks you if you want to play the game of economics. In this game, you play whether you want to or not. That is because the game of economics is going on all the time. It is played at every second of every day in all parts of the world.

Since you are already playing the game of economics, you should know what kind of game it is and learn the rules. That way you can play it as well as possible.

Introduction

The study of economics is important because the economy — global, national, local, and personal — effects what you do every day. Economics influences the work you do, where you live, what you eat, how you dress, whether there is gas available for your car, and more. Economics also influences government policy and international relations including wars.

Understanding the basics of economics will help you make good personal financial choices and will help you make wise environmental and political decisions, as well.

We will start by learning that economics is not a collection of «other» people but a complex system in which every individual has roles and goals.

We will also explain the four fundamental questions of economics and how, depending on the way these questions are answered, the game changes. Very soon, you will be well on your way to understanding what the economy is all about and how it relates to your everyday life.

Some games are similar to each other. Take basketball and soccer, for instance. They both have two sides consisting of a set number of players. There are specific ways to score points. There is a winner at the end of a set amount of time. So, although basketball and soccer are different games, they have much in common.

But what about checkers and soccer? Maybe there are one or two similarities, but the ways to win are very different. In soccer, the team that scores more points wins. In checkers, a player who takes all his or her opponent’s pieces is the winner.

Is there anything that is the same in every kind of game?

Playing by the Rules

Are there any games that allow players to do whatever they want? No. All games have rules. There are important rules in economics, too.

In economics, the rules are usually laws. Laws are rules that define what is and is not allowed. For example, you cannot steal from others. That is a law, and it is also one of the rules of economics. Another law is that exchanges must be voluntary. Consumers cannot be forced to buy things. Voluntary exchange is a rule of economics, and it is also a law.

Rules and Properties

Games require that people play by certain rules, but that is not all there is to games. Games are fun precisely because there is more to them than just the rules.

In tag, we all know to avoid the person who is «it.» This is not a rule. There is no penalty if we do not follow it. But even though it is not a rule, it has an effect on how the game is played.

Anything that is not a rule but still affects how a game is played is called a property. The properties of a game follow naturally from the rules, but they also add something to the game that goes beyond the rules. This is how economics works.

Economic Properties

Like all games, economics has properties in addition to the rules. These properties affect how the game is played.

Remember: One of the rules of economics is «no stealing.» If you want to make an exchange, the buyer and seller have to agree on the price and then make the exchange. The rule, however, does not tell you how much the price will be. It could be any amount.

This is not true for all games. In Monopoly, prices are set by the rules. A railroad costs $200. But in economics, unless there is a specific law that sets the price, the amount is up to the buyer and seller.

How do prices get set if the rules do not set them? One of the properties of economics helps: Buy low, sell high.

Why is this a property of economics? The buyer is giving up something good: money. So, the buyer usually wants to pay as little as possible. The seller, on the other hand, wants to get as much money as possible. Buyers want lower prices, and sellers want higher prices. Hence, buy low, sell high.

While almost all buyers and sellers play the game like this, it is not a rule. You do not go to jail if you sell something for a lower price than you could have. You are not a criminal if you pay more for something than you have to.

In economics, there are a lot of properties. Sometimes, economists call them «laws,» but they are not laws like «no stealing» is a law. They are properties, like «buy low, sell high.»

One of these properties is called «The Law of Supply and Demand.» Despite the name, «The Law of Supply and Demand» is actually a property, not a law. This property can be complicated, but one part of it states that when the supply of something is low and the demand is high, then the price will be high. Why? It is related to the «buy low, sell high» property.

Let us say someone has a rare object, like one of the few original copies of the Declaration of Independence. What if you wanted to buy that rare object? You cannot steal it. That is a rule. And as a buyer, you want to pay as little as possible.

So, you offer a low price. But there are other buyers, too. If you want to buy this rare copy of the Declaration of Independence, you have to compete with the other buyers. Someone else also wants it badly, so they offer more than you. Now, you cannot go somewhere else to buy because it is rare. If you want it, you have to offer more. So, you do. But the other person offers more than you again. The price is going higher and higher. Why? Because of the «Law of Supply and Demand.»

No one is forced to obey this «law.» There is no Supply-and-Demand Police making sure this happens, but it happens all the time. Economists call this «The Law of Supply and Demand» instead of «The Property of Supply and Demand» because nearly everyone obeys it even though it is not actually a rule.

Outcomes

There is another feature common to all games. Every game has an outcome. Outcomes are the real heart of any game.

Outcomes also take place throughout the playing of a game. They result from plays or moves, but the idea is the same — one thing results in another.

Economics has many outcomes. A sale is a common example. When someone buys something, and the item and money change hands, that is an outcome. Later, we will take a look at other economic outcomes.

And the Winner Is — No One?

So far, we have seen that all games have certain features:

• Players

• Rules

• Properties

• Outcomes

It seems as if there is one more thing that is common to all games: a winner. Does an activity need a winner to be considered a game? Not necessarily.

Consider the game of tag. The players in tag are either «it» or «not it.» Which one is the winner? Do you win if you are not it? No, you are just one of the players who are not it. And being it does not make you the loser. You are just it until you tag someone else.

Tag has no winner because there is no rule that states when the game has to end. A game of tag does not end when somebody wins. It lasts until all the players decide to stop playing. Technically, a game of tag could go on forever. The same is true for economics.

Winners often get medals or trophies to show that they have won.

The Features of Games

To study economics, you need to understand how the various features of the game work. This means knowing about the different roles of the players and the rules they have to obey. It also means knowing about outcomes and understanding the properties that affect the way the game is played.

Economics is like a game. It has many of the attributes that all games have in common: players, rules, properties, and outcomes. But what kind of game is it? What do the players do?

Surprisingly, the answer is simple: Economics is a game in which players buy and sell goods and services. It has rules, properties, and outcomes that limit and direct how all that buying and selling takes place.

Goods and Services

Objects that fulfill someone’s needs and wants are called goods. You need food. A sandwich is a good that fulfills that need. Every time you buy a sandwich, you are a player in the game of economics.

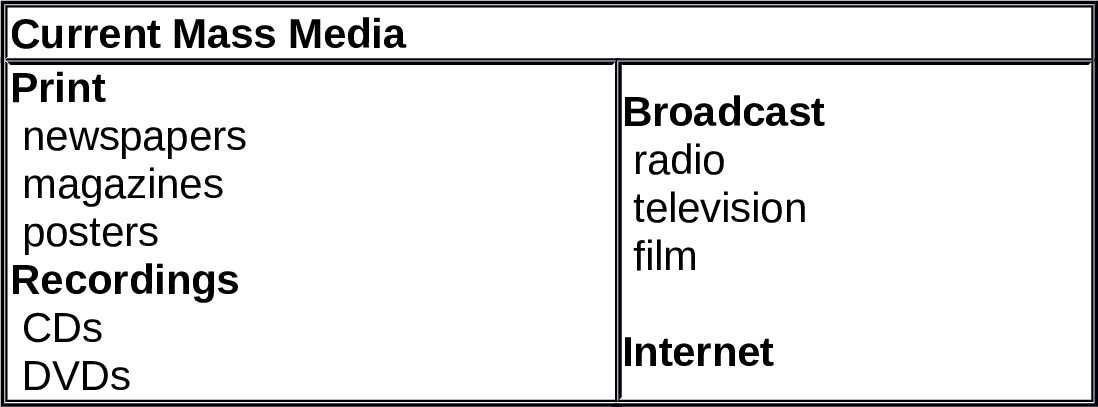

What about things you want? Do you want to surf the Internet? A computer fulfills that want. A computer is a good. A DVD fulfills the want for entertainment, so it is a good, too. Just about every object fulfills some need or want.

All foods are goods, even if they do not taste good.

Sometimes our wants and needs cannot be fulfilled by goods, or objects. In that case, we might require a service. Services are actions or other types of assistance that customers need and want.

For example, when you need a trim, or you want to change your style, you get a haircut. But a haircut it is not an object. It is a service. Someone with a specific skill works to give you the trim you need or the style you want. Your stylist performs an action, or a service. However, he or she makes use of goods, such as scissors and a comb, to perform the service.

Giving someone a haircut is a service that requires goods like scissors and a comb.

Is Economics About Everything?

Not everything is a good or a service. For instance, when you pay someone to mow your lawn, you are buying a service. But when you mow your own lawn, you are just making the grass shorter.

In other words, an action that you perform for your own benefit is not a service. If you read a book, you are not doing anybody a service. You may be relaxing or learning. These are good things, but they are not services because you do them for yourself.

On the other hand, if you read a book out loud to somebody else, you are performing a service. A service is still a service even if someone offers it for free, but services rendered generally involve the exchange of money. The exchange might also be made using the barter system.

What Is Production?

Goods and services need to be made. This is known as production. Production is one of the things certain players in the game of economics do. A player who does this is known as a producer.

Production does not just happen. There are required to produce goods and services. Something needed for production is called a resource.

For example, you need flour to make a cake. The cake is a good, and the flour is a resource. Where did the flour come from? Originally, it came from a wheat field. So, the wheat field is a resource, too.

What It Takes to Make a Birthday Cake?

Let us say you want to make a birthday cake for someone. That is a service. It takes action to make a cake, and this action is valued. And it produces a good — a birthday cake. One of the main services in any economy is making goods. This service, called production, requires all kinds of resources. To make a cake, you need a kitchen. A kitchen is a resource.

Of course, you also need the stuff you make the good out of. If you are making a cake, you need flour and eggs and sugar and everything else in the recipe. These are some of the resources you need to make the cake. But you also need bowls, spoons, measuring cups, and a pan. These are resources, too. And finally, you need time and knowledge. In the end, you will put in a lot of effort. All of these things — time, knowledge, and effort — are resources.

Even a genie, who can make a birthday cake out of thin air, has to do something. Maybe the only action they have to take is saying, «Abracadabra.» But that still takes up the genie’s time and requires genie powers. Time and genie powers are resources. Even a genie needs some resources to produce a birthday cake.

Allocation

Resources are essential for production. But very few resources are easily available and ready to be used. Resources need to be found and set aside to produce specific goods. That is known as allocation.

Allocation involves making decisions. If you have a bag of flour, you have to decide whether you want to make cake or bread. That is a decision about the allocation of this resource.

Economics is a game of constant decision making. A lot of these decisions have to do with allocation.

Making decisions about how to allocate resources is part of many games, not just economics. A softball coach allocates players by deciding who plays what position and making the batting order.

What will you do with your flour?

Distribution and Consumption

Economics is about the allocation of resources to produce goods, but what do we do with these goods once they are produced? We use them, of course.

Using a good or a service is known as consumption. In the game of economics, people consume goods that are produced. When a player uses a good or service, he or she is known as a consumer.

Goods are rarely produced where they are used. If you have a piece of clothing with a label that says «Made in China,» it had to travel a long way to get to you.

Moving goods to consumers is known as distribution. Producers have to distribute goods to the people who want to consume them. Resources get distributed, too.

Perhaps you want to bake a friend a birthday cake, so you buy a bag of flour. Think of all the distribution the flour has to go through to get to you:

It starts out as wheat in a field far away. After harvest, it is sent to a flour mill. This takes resources, such as a truck, gasoline, and a driver. When the milled flour gets loaded onto another truck to be shipped to a warehouse, it takes more resources. From the warehouse, the flour is loaded onto more delivery trucks and taken to the store, requiring still more resources. Finally, the bag of flour has arrived at the store for you to buy. You become the final stage of distribution when you take the flour from the store to your kitchen.

Producing goods takes resources, and so does distributing them. You need trucks and trains and ships, and they need gas and tires and so on. These resources have to be allocated, as well. So, in addition to the allocation of resources for producing goods and services, economics is also about allocating resources for distribution.

Many goods that we use in the United States are made in other countries.

So, what is Economics About, Again?

You have seen that economics is about producing goods and services for people to consume. You have also seen that production requires resources, as well as decisions about the allocation of these resources. Finally, you saw that goods and resources need to be distributed from where they are produced to where they are used. If you put all of this together, you should have a good idea of what the game of economics is about.

Goals are a big part of economics. They help us avoid uncertainty. Goals also help us make crucial decisions.

Imagine you are playing softball. You know the rules, but you still have many decisions to make. Should you pitch a curveball or a fastball? Should you swing at a ball, or wait for a better pitch? Should you steal second base, or wait on first? Without a goal, it would be hard to answer these questions.

If you have a goal, the answers are obvious. If your goal is to win the game, you know what to do — throw your best pitch, try hard to hit the ball, and steal as many bases as you can without getting thrown out. These are the things that players need to do to win.

Economic Goals

In the game of economics, you need goals to avoid confusion and to know what to do with yourself. Different people have different goals, however. You may think the only goal in economics is to make money, but there are many different goals in economics.

Different economic goals affect how people approach making decisions in the game of economics. If your goal is efficiency, it is likely that you are going to allocate resources for the production and distribution of goods and services differently than a person whose goal is security or freedom.

Read through the list to see the different economic goals that people pursue. Each will be defined in the coming pages.

Goals for Playing the Game of Economics

1. Efficiency

2. Growth

3. Security

4. Equity

5. Freedom

Efficiency, Growth, and Security

The first three economic goals — efficiency, growth, and security — are goals that make a lot of sense. But that does not mean that everyone agrees these are the proper goals to pursue when deciding how to allocate resources.

• Efficiency refers to the use of resources in a manner that gets as much out of them as possible. Efficiency is a goal producer have, to provide more goods and services for society without using more resources.

• Growth means increasing the size, number, or output of goods or services. It makes sense to want growth, because in the economy, growth means more goods, more jobs, and more money.

• Security is protection against risk or danger. Because life is uncertain and bad things can happen, the economic goal of security encourages us to lessen the dangers we face.

It is Not Fair

Another economic goal is equity. Equity means fairness; It is the notion that everyone should be treated equally. If a game is not played fairly, then the outcome will be unfair. When a game is fair, it has equity.

Still, equity can be a tricky concept. Different people might have different ideas about what is fair. Also, it is not always clear what is fair in a particular situation. Is it fair that one person has a lot while someone else has nothing?

Questions of fairness are not always easy to answer. Maybe the person with less does not deserve more. Consider the fable of the ant and the grasshopper.

The Ant and the Grasshopper

The ant worked hard all summer, building a house, and stocking up on supplies for the winter. The grasshopper danced and played the summer away. When the winter came, the ant had plenty of food to survive. The grasshopper had no food and died of starvation.

What is Fair?

Competing ideas about what is fair is a common problem when pursuing the goal of equity. This makes equity a problematic goal for economics. Although equity is a good thing to pursue, it is rarely obvious how to achieve it.

At the end of the story on the previous page, the grasshopper had nothing, and the ant had plenty. Is that fair? It depends on your perspective.

View the Ant and the Grasshopper to hear each side of the story, from the ant’s industriousness to the grasshopper’s cluelessness.

I’m sad that the grasshopper did not know what to do to prepare for winter, but I do not think it is fair to take food from me to help keep him alive. That would be rewarding the grasshopper for his lack of foresight and punishing me for my industriousness. It is not fair to punish someone for doing the right thing.

I do not think it is fair that I should have to starve. I have never seen the winter before, so I did not know what would happen. No one told me I would have to build a house and gather supplies. Do I deserve to die in the cold because I did not know about the harsh conditions I would have to face? Since I did not know, it is not fair to let me die. Would not it be fair to take some of the ant’s food to help me out?

Let Freedom Ring

Another important economic goal is freedom. Just like equity, however, freedom is a tricky concept. It can mean different things to different people.

Freedom in economics is defined as the absence of an obstacle or constraint. But what is the obstacle or constraint, and how can it be removed? Different obstacles and constraints present themselves to different people in innumerable situations.

The Statue of Liberty represents freedom, but not everyone defines freedom the same way.

The Two Faces of Freedom

It is normal for people to have different ideas about freedom. Freedom is the absence of an obstacle, but the obstacles people face are not always the same, so their ideas about freedom can be very different.

For a teenager, one obstacle might be rules set by one’s parents. For a parent, an obstacle to freedom might be his or her struggle to earn money for the family.

In the game of economics, different ideas about freedom lead to different ways of looking at the allocation of resources. If you think of freedom in terms of people making their own choices, you might believe that producers should get to decide how goods and services are produced without any constraints. But if you think of freedom as the absence of economic struggle and need, you might believe the government should tell the producers what to make and how much to charge so that everyone’s basic needs can be met. These different views of economic freedom lead to different ideas about how an economy should function.

Conflict Over Goals

With goals that are sometimes incompatible, economics can lead to conflict. Do you want efficiency, growth, security, equity, freedom, or some combination? You need to have some goals, but someone else will inevitably have different goals. No matter what you want, there are bound to be other people who want something else. This can create conflict.

This means that there is more to economics than the allocation of resources for the production and distribution of goods and services. Economics is also about setting goals that affect how these allocation decisions are made.

We All Need Goals

You cannot play a game without goals. How else can you make important decisions? But people often disagree about the goals they have for playing a game.

Things are no different in the game of economics. The goals people have for the economy might be different. They might even be incompatible sometimes. Nevertheless, you need goals to play this or any game.

Humans have wants and needs that are often greater than what is available. Thus, people face scarcity as a basic fact of life.

You might think that there are plenty of goods and services available to you. But what would happen if the world stopped producing the thing you need or want? Eventually, the supply would run out. When goods and services become hard to find, it leads to scarcity.

You saw before that economics is about the allocation of resources for the production and distribution of goods and services. The problem of scarcity is the reason that this is necessary. If there were plenty of goods and services to go around, no one would need to make allocation decisions. Scarcity is yet another reason why everyone plays economics.

People can face shortages of important goods.

What Is to Be Produced?

Because scarcity is a fact of life, people have to work to try to increase supply in order to meet demand. Different people want different goods and services. If there were unlimited resources, people everywhere could have what they wanted.

Since resources are not unlimited everyone has to make tough decisions about what to do with the resources available. One big question that needs to be addressed in any economy is this: What is to be produced?

Because of scarcity, deciding what is to be produced involves also deciding what not to produce.

Remember your bag of flour? You can allocate the flour for making bread for sandwiches. But what if it is your friend’s birthday? If you use the flour for bread, you cannot make a birthday cake. Before you start producing something, you have to decide what to produce.

Allocating resources often involves deciding to produce one thing instead of another.

Getting Organized

Once it is decided what will be produced, there are still more questions to answer. It takes organization to produce and distribute goods and services.

There are all kinds of ways to organize production. There could be factories, offices of varying sizes, or people working at home. There could be different people who specialize in different jobs, or everyone could take turns doing all the different jobs. Production might go on 24 hours a day, seven days a week, or it could be kept to certain working hours.

This is just a short list of the different options. There are many methods of organizing production. How do people decide on the best way to organize production? The economic goals people have will affect how this question is answered. This can again lead to conflict.

The goal of efficiency requires a form of organization that has as little waste as possible. One good way of eliminating waste is to have different workers specialize in different jobs. But if equity is the goal, specialization might not be the way to go. When you divide up production into different tasks, some of the tasks might be harder than others. Equity could mean giving each of these workers a chance to do the easier, cleaner job. But what if freedom is your main economic goal? In this case, production would have to be organized to give workers different choices, and workers would have the freedom to decide what jobs to take.

Who Gets What and Where?

The questions do not stop once decisions about production have been made. You saw that goods often need to be transported from where they are made to where they are used. This is distribution. There is more to distribution than just transportation, however.

Getting goods to the people who use them means making decisions about who gets what. Because of scarcity, some people will not always get what they want. So, the game of economics involves answering a third question: How are goods and services to be distributed?

In other words, how shall we decide who gets what?

If you want equity or security, producers probably need to be told what to produce. Their choices could end up being incompatible with those goals. The government can make sure that everyone is secure, or that goods and services are distributed fairly. But when the government decides how goods and services are distributed, that takes away free choice. Producers are told what to produce and where to send it. A different way to organize distribution is not to organize it at all, to leave it up to people’s free choices to decide what gets produced and how goods and services are distributed. This might result in an unfair distribution, or one that leaves some people insecure, but it would not involve the government telling people what to do.

A Variety of Resources

Organizing an economic system involves making decisions about what is going to be produced and how it should be distributed. That takes care of most of the game of economics.

Still, there is one final question to be answered: What is the most effective allocation of resources?

There are all kinds of resources that go into production and distribution. Remember all the resources needed to make a birthday cake? There are a lot of them: an oven, a timer, ingredients, utensils, time, knowledge, and effort.

Production and distribution usually involve a long list with very different types of resources. The flour needed for the batter is a different type of resource than the oven needed to bake the batter, or the time needed for the whole process.

Deciding how to allocate resources means you have to pay attention to where the different resources come from.

It takes many different resources to make a cake.

The Factors of Production

The types of resources needed for production are known as the factors of production. There are three different factors of production: land (in economics, the term land refers to any natural resource on, under, or over the land), labor, and capital.

Land is useful for making things. Fields are used to grow food, and water or wind can be used to produce energy. And land is not just what you see on the surface of the Earth. It also includes things that can be found underground. Things like coal and iron — even steam and water come from underground. These natural resources are all useful for producing things.

Some goods spring directly from the Earth, but it takes some work on the part of humans to make all goods. Even a wild blackberry has to be picked by someone before it can be eaten. All production requires a human touch. Labor is the work that humans do to take natural resources and turn them into useful products. Sometimes the labor is physical. Sometimes the labor involves coming up with ideas. Whatever form labor takes, these human resources are just as necessary as natural resources.

Capital is the final type of resource needed for production. Capital resources are goods that have been produced by humans to make more goods. Capital includes machines like bulldozers and cement trucks. It also includes buildings like factories and other structures such as dams and oil wells.

The term capital also refers to the money used to pay for other resources. Like other forms of capital, money has been created by humans to help with the process of production.

You can see that playing the game of economics involves answering a lot of different questions. There are four fundamental questions faced by people in all economic systems.

The way these four questions are answered tells you a lot about the way decisions are made in different economic systems. When these questions are answered in different ways, you end up playing different games.

Another major element in economics is the concept of supply and demand. The fundamentals of supply and demand change depending on what type of economic system you are dealing with, however, so this concept cannot be included in the fundamental questions of economics, in general.

The Four Fundamental Questions

1. What is to be produced?

2. How is production to be organized?

3. How are goods and services to be distributed?

4. What is the most effective allocation of resources?

You have seen that there are different economic goals that can be pursued: efficiency, growth, security, equity, and freedom. It can be difficult to decide among them.

Individual people are not the only ones who choose economic goals. Entire societies also make the same choices. If it is hard enough to choose for yourself, imagine how hard it is for a whole society to agree on its economic goals! To make this decision, it helps to understand the different results that occur from pursuing different goals.

For example, what would the game look like if everyone agreed that freedom was the most important goal? To answer this, you can look at how a society that values freedom would answer the four fundamental questions of economics. This tells you what a free-market system looks like.

The free-market system, sometimes referred to as capitalism, is one of the most common economic systems on Earth. Examine how it works.

Free Choice

The first question raised by scarcity: What will be produced?

When you are alone, you can answer the question based simply on your personal needs or wants. When an entire society decides what will be produced, however, it raises a different question first: Who within society gets to make the decision? This question needs to be asked and answered before the first fundamental question.

It might seem obvious that the producers themselves should get to decide what to produce. Their role is to produce goods and services, so it makes sense to let them choose. This is exactly what happens in a free-market system: Producers are free to choose what to produce.

Producers also get to choose how to organize production, which addresses the second question. In fact, producers are free to answer all four of the fundamental questions without anyone telling them what they have to do. A capitalist society is one where allocation, production, and distribution are organized by the free choices of the producers.

The Customer Is Always Right

Capitalism leaves production decisions up to the producers, but the choices made by consumers also play an important role. Producers must eventually sell their goods and services to consumers. In a free-market system, consumers have the freedom to choose what to buy. This gives them a lot of power over producers.

Producers want the goods and services they make to be purchased and used. That means producers must pay attention to what consumers need and want. If consumers choose not to buy the goods and services they produce, the producers have to make different decisions.

Because of this, the needs and wants of consumers influence the decisions of producers. In a free-market economy, the free choices of both producers and consumers determine how the fundamental questions are answered.

Go with the Flow

A free-market system is based on the free choices of producers and consumers. The choices one group makes affect the other group. Consumers can only consume what producers produce. At the same time, producers want to make only what consumers need and want.

Because of this back-and-forth influence, capitalism has a circular flow. Influences and inputs move between producers and consumers. Economists call this a circular-flow model.

View the Circular-Flow Model below to see the circular-flow model of the free-market system.

The Circular Flow Model

The main players in the free-market game are producers and consumers. There is a circular flow of influences and inputs between them. A circle has no beginning and no end, so there is no first influence or input — but we need to begin somewhere, so let us start with the producers. Producers make goods and provide services. These go to the consumers to be used. The consumers purchase these goods and services. Consumers also provide the factors of production by working and investing. Producers pay for the work with wages, and they repay and reward the investments with profits. These things flow back and forth, continuing the cycle as producers and consumers interact and influence each other’s decisions.

Defending Freedom

The free-market system is based on producers and consumers making free choices. But often, consumers and producers have desires that conflict.

Conflict results naturally from people’s desires, and some people try to resolve conflict by using threats to force people to choose in a certain way. This is called coercion. When your desires conflict with someone else, the other person might try to make up your mind for you by using coercion.

Because the free-market system relies on free choices, coercion is usually forbidden in capitalist societies. It is illegal to take away people’s right to choose through coercion. Laws in capitalist societies are designed to defend the freedom of producers and consumers.

The Rules of the Game

There are many ways to take away someone’s freedom. Thus, rules are needed to make sure producers and consumers can make free choices. You already know some of these rules. For instance: No stealing.

«No coercion» is another important rule. Coercion can include lying, so «no lying» is also part of the rules of a free-market system.

In economics, the rules are laws. That is why the government passes laws against theft, coercion, and fraud. In a free-market system, the government has to make and enforce whatever laws are needed to guarantee free choice.

Private Property

Maybe you currently have some amount of financial freedom. Maybe you get an allowance, or you have a part-time job that provides a bit of spending money. But what if your allowance was taken away or you lost your job? Then you might have to ask someone else for money. Since the people you ask are free to choose, they can say yes or no.

To be free, you need more than protection against coercion. You need to have resources, too. If you do not have your own resources, then your ability to make free choices is limited.

In a free-market system, individuals get to make free choices about what to do with the resources they have. Therefore, rules protecting private property are among the most important rules of a capitalist society. These rules are referred to as property rights.

Land is one of the resources that helps people be free.

The Resource of Work

Land, money, and capital are resources, but they are not the only resources that allow one to make free choices. Healthy adults who own no property still possess one important resource — their own labor. The ability to work is an important resource in a capitalist system.

The rules of the free-market system protect you against coercion. It is illegal for anyone to force you to do something. This means that the rules guarantee that you can make free choices about how you sell your labor to others.

Labor is an important resource. Almost all production requires some labor. So, everyone who can work has an important resource, the resource of work. Having this resource gives people the ability to make free choices.

Competition

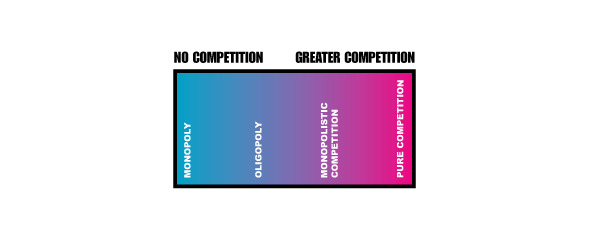

The free-market system relies on free choice and private property, but that is not all. Competition is another important part of capitalism.

Competition is needed to guarantee freedom. Without competition, people do not have a lot of choices. In fact, they might have only a single choice.

Free-market systems have to guarantee that there will be competition. It is one of the rules. Without competition, you would have to take the «free» out of free-market system.

Stock exchange

On the floor of the New York Stock Exchange, traders compete with each other to buy and sell shares.

The Importance of Competition

Imagine that you are hungry, and you want a sandwich. If there are a lot of different sandwich shops in competition with each other, then you will have a lot of choices. In fact, you will probably have fairly good choices. Because you can go to someone else, each shop is competing to get your business. This kind of competition gives the consumer a lot of good choices. They have got a lot of things to freely choose among.

But what if there were only one sandwich vendor? As a consumer, you would have to go to this one sandwich vendor and take what they had. Maybe they only have tuna fish sandwiches that cost $20. You do not even like tuna fish sandwiches, and you definitely do not want to pay $20 for one. But what other choice do you have? You have to buy the $20 tuna-fish sandwich or go hungry. You can always choose no sandwich and starve, but that is not much of a choice, is it? If your freedom consists solely of choosing between something you do not want — an expensive sandwich you won’t like — and something else you do not want — starvation — then it is hardly worth calling it freedom. Without competition, consumers do not have the freedom they are supposed to have.

The Profit Motive

Free choice, private property, and competition are at the heart of the free-market system. They are so important that there are rules protecting them.

We saw before that games often have properties in addition to the rules. Such properties are not enforced like rules, but they affect how a game is played. Properties of the free-market system are often called market forces.

One important market force in a capitalist system is the profit motive. Producers make a profit by selling a good or service for more than it costs to produce. The difference between the total cost of production and the selling price is the producer’s profit. If the cost is greater, the producer suffers a loss and will struggle to stay in business.

There is no rule that says you have to follow the profit motive because there does not need to be such a rule. It is obvious to any producer that a profit is better than a loss. In the free-market system, the profit motive exists without any kind of coercion.

Profit and Competition

The profit motive is extremely important for the free-market system. Because of competition, efficiency and innovation often result from this drive to make a profit. If you are competing with others, you cannot afford waste. Waste increases costs, which cuts into profit. So producers work hard to be as efficient as possible.

Competition keeps prices low, which means that producers cannot just make up for inefficiency by raising prices. The incentive to be efficient and innovative is an example of market forces.

The profit motive can also work against competition. If you really want to make a lot of money, it would be better not to have any competition. That way, you could sell your goods and services for a much higher price and make more profit. Profit seekers have an incentive to get rid of competitors, if they can, to make more profit. This is another reason it is necessary for the government to make laws protecting competition.

What is So Free About a Free Market?

You have seen that the free-market system is based on free choice, private property, competition, and the profit motive. These rules and properties create one particular version of the game of economics. It is just one version, but it is the game that most societies play.

Advocates of the free-market system might argue that the most important goal is freedom. Freedom is so desirable, they might say, that it makes it worthwhile to sacrifice other goals. Some advocates of the free-market system, however, think that we might not need to make these sacrifices. They believe that pursuing freedom allows us to reach the other goals as well.

Adam Smith was an early advocate of the free-market system. In the same year that the Declaration of Independence was written, he published a book called An Inquiry into the Nature and Causes of the Wealth of Nations. It is often simply called The Wealth of Nations.

Modern free-market advocates often cite Adam Smith to support their claim that freedom is the most important economic goal. Read some of what Smith said so you can judge the claims of the free-market supporters who agree with his reasoning.

Adam Smith is sometimes called the founder of capitalism.

Read the following excerpt from The Wealth of Nations and think about the things that Adam Smith said about the free-market system.

As every individual, therefore, endeavours as much as he can both to employ his capital in the support of domestic industry, and so to direct that industry that its produce may be of the greatest value; every individual necessarily labours to render the annual revenue of the society as great as he can. He generally, indeed, neither intends to promote the public interest, nor knows how much he is promoting it. By preferring the support of domestic to that of foreign industry, he intends only his own security; and by directing that industry in such a manner as its produce may be of the greatest value, he intends only his own gain, and he is in this, as in many other cases, led by an invisible hand to promote an end which was no part of his intention. Nor is it always the worse for the society that it was no part of it. By pursuing his own interest, he frequently promotes that of the society more effectually than when he really intends to promote it. I have never known much good done by those who affected to trade for the public good. It is an affectation, indeed, not very common among merchants, and very few words need be employed in dissuading them from it.

What is the species of domestic industry which his capital can employ, and of which the produce is likely to be of the greatest value, every individual, it is evident, can, in his local situation, judge much better than any statesman or lawgiver can do for him. The statesman who should attempt to direct private people in what manner they ought to employ their capitals would not only load himself with a most unnecessary attention, but assume an authority which could safely be trusted, not only to no single person, but to no council or senate whatever, and which would nowhere be so dangerous as in the hands of a man who had folly and presumption enough to fancy himself fit to exercise it ….

The property which every man has in his own labour, as it is the original foundation of all other property, so it is the most sacred and inviolable. The patrimony of a poor man lies in the strength and dexterity of his hands; and to hinder him from employing this strength and dexterity in what manner he thinks proper without injury to his neighbour, is a plain violation of this most sacred property. It is a manifest encroachment upon the just liberty both of the workman, and of those who might be disposed to employ him. As it hinders the one from working at what he thinks proper, so it hinders the others from employing whom they think proper. To judge whether he is fit to be employed, may surely be trusted to the discretion of the employers whose interest it so much concerns. The affected anxiety of the law-giver lest they should employ an improper person, is evidently as impertinent as it is oppressive…

People of the same trade seldom meet together, even for merriment and diversion, but the conversation ends in a conspiracy against the public, or in some contrivance to raise prices. It is impossible indeed to prevent such meetings, by any law which either could be executed, or would be consistent with liberty and justice. But though the law cannot hinder people of the same trade from sometimes assembling together, it ought to do nothing to facilitate such assemblies; much less to render them necessary.

The Invisible Hand

An important part of Smith’s theory is the «invisible hand.» He did not believe that a literal hand guides economic outcome. The invisible hand is a metaphor or symbol of market forces in the free-market system that lead to good outcomes without any planning. Because of this invisible hand, pursuing freedom helps realize other economic goals such as efficiency, growth, and security.

Smith clearly did not trust governments to direct economic affairs. Individuals pursuing their interests can «judge much better than any statesman or lawgiver can» what is best for the economy. Smith was very suspicious of government intervention in the economy.

Smith was also wary of producers since their pursuit of profit might persuade them to work against competition. That is what he meant by «some contrivance to raise prices.» He recognized that the government has a role to play in the game of economics. He believed that the government’s role should be limited to protecting such things as competition, free choice, and private property. The government should not have «folly and presumption enough» to believe it can run the economy directly. According to

Smith The invisible hand is not actually a hand.

It is better for everyone if the economy is left in the hands of private individuals pursuing their own interests. That is the invisible hand at work.

A different ball and different methods of pitching make softball and baseball two different games.

Playing the game of economics involves answering four fundamental questions. When they are answered differently, different games result.

Think about softball and baseball. They are similar games with a few important differences. This is also true for economics. There is more than one way to set up the rules. This means there are different versions of the game of economics.

The four all-important questions are

• What will be produced?

• How should production be organized?

• How will goods and services be distributed?

• What is the most effective allocation of resources?

Do What I Say and What I Do

A command economy has less freedom than a free-market system. Producers have to do what the government says. They do not get to decide what to make or how to make it. Also, people do not get to decide where they will work. The government decides that. This is why it is called a command economy: The government issues a lot of commands.

In a command economy, the government controls everything related to the allocation of resources and the production and distribution of goods and services. In order to do this, the government owns most of the property. Private property is an important feature of the free-market system, but it gets in the way of a command economy.

The following is a long list of government functions in a planned economy. The list goes on and on, but these are the fundamental commands issued in a command economy.

Government Commands

In a command economy, the government

1. Assigns production to producers.

2. Allocates resources to producers.

3. Sets prices for consumers.

4. Decides where people work.

5. Sets wages for workers.

6. Sells goods and services.

7. Decides who gets what and how much.

Your Wish Is the Government’s Command

Why would a government do all of this commanding?

There are other economic goals besides freedom and efficiency, and capitalism does not always serve these other goals. The free choices of producers and consumers often result in inequality and insecurity. Growth is sometimes strong and sometimes weak. People may be free to make choices, but they are often not free from struggle and need.

Command economies exist to serve other economic goals, usually equity, security, and freedom from need. These are the main concerns of both socialism and communism. Most nations have some elements of socialism as you will see later, but some countries have attempted complete socialism. Communism combines extreme socialism with political ideology. The former Soviet Union was a communist country. Today, China, North Korea, Vietnam, Laos, and Cuba still have communist governments though most have incorporated elements of capitalism. The philosophical goal of a command economy is to ensure equity and security. But under communism, the reality has been quite different. While some communist economies improved from what they were under previous authoritarian governments, none has achieved true equity or efficiency, and none has reached its economic potential. Some, such as North Korea, have had disastrous economic consequences. Additionally, these governments remain politically repressive.

Making a Plan

Free-market systems and command economies have different goals. But the differences do not end there. For one thing, a command economy has an extra set of players. There are producers and consumers, as in any economic system. There are also government planners. The planners are the ones who issue the commands.

In a free-market system, outcomes are not planned by anybody. They happen because of market forces. The law of supply and demand sets prices. Demand for different types of labor decides where people will work and how much they will make. Voluntary exchanges determine how resources are allocated.

In a command economy, these things are decided by the government instead of by market forces. Planners decide how to allocate resources for the production and distribution of goods and services. This means they decide what gets produced, they organize production, and they also decide which consumers will receive what and how much. In a command economy, planners, not producers, answer the four fundamental questions.

Diverting the Flow

The free-market system operates with a circular flow between producers and consumers. In a command economy, the flow is different because of the important role played by government planners. Their decisions affect almost everything that goes on in the economy.

A game with three sets of players is obviously very different from a game with two sets of players. A command economy has a flow that involves the planners at almost every step.

Remember how the circular flow model of the free-market system works? Inputs and influences go back and forth between producers and consumers. In a command economy, government planners get involved. What they do changes the flow. Goods and services are purchased from the government, and the money paid returns in the form of wages. Profit is eliminated. Diverting the flow of the free market this way tends to slow things down.

In a command economy, planners have to figure out what resources are needed to reach their society’s goals, and they have to figure out how to organize production. Collecting information and coordinating decisions use up a lot of labor, so there are fewer workers to contribute to production. This limits growth. The command economy also cuts down on efficiency and innovation. Planners are focused on organizing resources to meet society’s goals. They do not have much time or incentive to come up with the new products or different ways of doing things.

The Land of the (Mostly) Free Market

You have examined two different economic systems: the free-market system and the command economy. Both of these systems are based on a theory about how the economy should be organized. In reality, most economies are a mixture of both.

The United States has a free-market system — mostly. Almost all decisions are made by the free choices of producers and consumers. Still, there are parts of the U.S. economy that are planned. The government sometimes issues commands that limit the freedom of producers and consumers. These commands serve economic goals other than freedom and efficiency.

For example, minimum wage laws limit the freedom of producers by telling them the lowest wage they can pay their workers. The goal of a minimum wage is to promote economic security and equity by protecting workers from exploitation. Not everyone agrees that a minimum wage accomplishes this goal, and the value of minimum wage laws is frequently debated.

To many people, the free-market system is an important part of what the American flag represents.

It is in the Mix

When you mix two things, you can often get the best of both.

Freedom matters in the United States, but it is not the only thing that counts. Efficiency is important too, as are equity, security, and growth. This is why the U.S. government issues some commands, which means that the United States has a mixed economy. A mixed economy uses both free-market and command principles.

In freedom-oriented societies such as the United States, the commands are the exception rather than the rule — but the exceptions are usually quite important. The government limits freedom to serve other economic goals in areas that matter most.

The minimum wage has the goal of promoting security and equity by not allowing employers to exploit their workers. Experts disagree on its effectiveness.

Retirement is another important feature of a mixed economy. Social Security is a government program designed to ensure that retired workers age 66 or older receive a continuing income after retirement. Social Security was not intended to be a person’s only retirement income and the system faces difficulties.

People are free to, and should, save for retirement in other ways in the private sector to ensure a better quality of retired life.

Stay in School

One familiar example of government command in the United States is the public-school system. This system provides a useful service: education. This service is so important for all people that the government does not leave it up to producers to organize. The states provide this service themselves. While producers may provide education through a variety of private schools, government guarantees free education to all. In fact, all parents have to provide their children with either public or private education up to at least age 16.

This is an example of the operation of a command economy within the United States. But free-market principles also operate. Even though the government guarantees that an education will be provided to all, a system of private schools exists to give parents a choice of where to send their children. This is not true in a pure command economy. There were no private schools in the Soviet Union.

Take Advantage

Free-market systems and command economies both have advantages and disadvantages. The free-market system serves the goals of freedom and efficiency very well.

Command economies do a better job of providing security and equity. There are ups and downs to both systems, and no one would try to argue that either system is perfect. But is one a clear favorite over the other?

The Pros and Cons of the Two Systems

Free-market systems usually provide a much greater variety of goods and services. Competition among producers leads to innovation as the producers try to figure out what consumers need and want. This innovation inspires a diversity of goods and services that is not likely to exist in a command economy. Planners do not have much incentive to innovate. On the other hand, a command economy can make sure that everyone has their basic needs met. Planners can direct the production and distribution of goods and services such as food, medical care, and education to guarantee that everyone gets these important things.

Inequality of wealth is one of the disadvantages of the free-market system. When people are given the freedom to make different choices, they each get a different outcome. Inequality is bound to result when wealth is distributed by free choices instead of an overall plan. This can lead to insecurity, too. A command economy can provide greater equality and security but at the cost of efficiency. Planners may be able to implement an overall plan that assures that basic needs are met, and wealth is distributed more equally, but the planning required uses up a lot of resources. When market forces do the work, resources are not wasted paying, housing, and feeding government planners.

What is Big Brother Doing?

There are important differences between a free-market system and a command economy. In capitalist societies, the government does very little to interfere with the economy. Market forces, or the «invisible hand» is expected to allow the economy to function properly.

In a planned economy, the government takes on the job of the market forces. This uses up a lot of resources.

There are advantages and disadvantages to both approaches. That is probably why most countries have a mixed economy, so they can get some of the advantages of each system and pursue several economic goals at once.

Life is full of decisions. So is the game of economics.

Players decide on economic goals. They decide on the rules of the game. They make allocation and production decisions. They decide what to exchange and for how much to exchange it.

Making decisions never really ends in the game of economics. In fact, the economy is primarily just a constant stream of decisions and their outcomes.

So how are economic decisions made? Let us take a look.

Yogi Berra, one of the greatest baseball players ever, once said about the game, «It ain’t over til it is over.» This is not just true in the game of baseball. It is also true in the game of economics. No economic decision is over until it is over. In other words, you are not done with the decision-making process until you have carried out your decision. Even when you have already decided on a plan, you still have to decide whether to stick to it.

Life is all about personal choices. Sometimes decisions are easy; at other times they are difficult and require a lot of thought and maybe even sacrifice. Sometimes our decisions affect other people. This is true in baseball as well as in economics.

Weighing Pros and Cons

Compare going to see a movie with a trip to the dentist. Which sounds better: relaxing with a bucket of popcorn and a soda, or having someone poke around in your mouth with a metal instrument? If you are like most people, you would probably rather go to a movie than visit the dentist.

Think about it, however. There are pros, or positive aspects, to going to the dentist. And there are cons, or negative features, of going to the movies. Not even this decision is completely one-sided.

Cost-Benefit Analysis

Making decisions requires weighing the pros and cons. Good decisions can only be made after considering the different choices and picking the one that looks best. That is what players in the game of economics do.

Economists call this cost-benefit analysis. When you do a cost-benefit analysis, you look for the decision that has the maximum benefit with the minimum cost. In other words, the choice with the most pros and the fewest cons is usually the best option.

Be Rational

There is no rule that says you have to use cost-benefit analysis, but players who want to maximize benefits and minimize costs use it all the time. It is one of the properties of the game of economics.

You do not always have to list the pros and cons to do cost-benefit analyses. In fact, such an analysis happens frequently, and almost automatically. Any time you accept a cost, you are looking for a benefit. You have probably done a cost-benefit analysis of your own, even if you did not sit down to make a list of pros and cons.

Money Is not Everything

Money is one common way of calculating cost. You see price tags all over the place. It is normal to think of cost and price as the same thing, but the cost of a decision cannot be measured in money alone.

When you buy something with money, there are always additional costs. For instance, the time and effort involved in shopping are costs. And whatever you must give up by buying one thing instead of another is also a cost.

Imagine that you received $200 in birthday money. That is quite a benefit, but spending it involves costs. Maybe you decide to buy a new game console with the money. The price of the console is only one factor. There are hidden costs, too, such as gas for the car or bus fare to get to the store. The time you spend is another cost. So, while it may seem that you are getting something for free — a console bought with someone else’s money — buying it brings certain costs. And maybe you wanted a new backpack and a pair of shoes, too. You are sacrificing those purchases for the game console.

That is Your Opinion

Cost goes beyond money. No price tag reveals the full cost of something. Everyone’s feelings about cost are very personal. The way you calculate the cost of a decision depends very much on your tastes and your situation.

Whenever you buy something, there is a cost in time and effort beyond the price of the purchase. The time and effort spent on a task may be a high cost for one person and a low cost for another. An hour spent shopping probably seems like a low cost for someone who loves to shop — it may even seem like a benefit. But an hour spent shopping may be a very high cost for someone who does not like to shop. Time and effort are non-monetary costs of shopping.

Even monetary costs can vary depending on a person’s situation. If you are a millionaire, paying $10 for a movie is not a big deal. If your job pays $7 an hour, however, that $10 may seem like a lot of money.

Everyone calculates costs and benefits differently. That makes these calculations subjective. In other words, they depend on a lot of factors that vary from one person to another. Because people’s opinions and tastes differ, it affects how they see the costs and benefits of decisions.

Something’s Missing

Unfortunately, not all rational decisions work out the way you might hope. Sometimes you ignore a cost, or overestimate the benefits. This does not mean you are irrational. You simply could not think of everything.

Often, it is impossible to predict what is going to happen. Unexpected costs arise. Benefits turn out to be less than you thought. That is normal, because no one can predict the future. That does not mean a cost-benefit analysis is useless, though.

Economic Reasoning

Cost-benefit analysis is sometimes called economic reasoning. In many ways, economic reasoning is just like any other kind of reasoning — it is a matter of weighing pros and cons.

Some might call this logic, others common sense. Whether you call it economic reasoning, logic, or common sense, it is all the same thing. It is how people play the game of economics. They make rational decisions hoping for benefits that outweigh costs.

There is no such thing as a free lunch, even when someone else is buying.

The economy is not just a collection of people. It is like a game, except that instead of playing on a board or a field, the players move within the greater economic system. They follow rules and make decisions, and these decisions result in outcomes.

Definition of the Economy

The economy is the total of all the outcomes that result from people participating in the economic system.

Economists measure and discuss the strength and performance of the economy. When they use words such as health, vitality, and even stamina, it sounds much like a doctor talking about a patient. This is not far from the truth.

Economic Indicators

Economists measure the health of the economy by comparing and analyzing economic outcomes that result from various activities. Economists use these instruments to measure economic activity. These instruments, called economic indicators, include

• Gross domestic product.

• Growth rates.

• Unemployment rates.

• Inflation rates.

Doctors use measurements to judge the condition of their patients. Economists measure the health of the economy.

Gross Domestic Product

Some indicators are used quite often to measure the health and vitality of the economy. For example, gross domestic product (GDP) is a very helpful, and widely used, tool.

The GDP measures the overall size of a country’s economy. It is the monetary value of all goods and services produced in a country during a given time, usually one year. The GDP provides a good overall picture of how much economic activity there is within a country.

Understanding GDP

Gross domestic product is the sum total of private consumption, government spending, investment, and the net value of exports. The net value of exports, sometimes called the trade balance, is the value of the goods exported minus the goods imported.

The equation can be put more concisely as follows:

GDP = private consumption + government spending + investment + exports — imports

A common mathematical formula for measuring GDP looks like this:

GDP = C + G + I + Ex — Im

Private consumption includes all the goods and service purchased or consumed by individuals. Government spending includes all the costs incurred by the government, such as salaries of government employees, military spending, funding for education, and so on. Investment is limited to business investments in capital, and it does not include financial investments such as savings accounts or bonds. Exports are those goods that are produced inside one country and sold in another country. Imports are the reverse — goods made outside the country and purchased within the country. Imports are subtracted from the GDP because they are purchased from other countries before they are sold within the United States. These funds contribute to another country’s GDP.

The GDP is a very weighty number for every country in the world.

World GDP

GDP is an important economic indicator. The bigger the GDP, the more activity there is in a country’s economy. For large countries, the GDP numbers are likewise usually very large. Sometimes a country’s GDP is so large that it is hard to comprehend. So what does a GDP number really tell us?

There are a couple of ways to make the GDP more meaningful. One is to make comparisons. For example, in 2011, the GDP for the entire world was just under $70 trillion. The same year, the GDP of the United States was about $15 trillion. That means that roughly one-fifth of all economic activity in the world took place in the United States. That is a lot of economic activity for one country.

The United States has the largest GDP in the world, as evidenced by our many shopping malls.

Annual GDP

You can also compare the GDP from one year to the next, which gives an indication of economic growth on an annual basis, or year by year. For instance, if a country’s GDP grows by 10 percent from one year to the next, the economy is growing rapidly. If its GDP goes down, the economy is weakening. If the GDP stays about the same, the economy is stagnating.

Another way of making the GDP useful is to look at per capita GDP. To do this, you divide a country’s GDP by its population. This tells you the average amount of economic activity contributed by each person in that country.

Growing Up

There are measurements for almost every type of economic activity. These measurements are usually reported as growth rates. Growth rates show how much economic activity there is in specific parts of the economy.

There are additional indicators that show how fast the economy is growing (or shrinking) in particular areas. There are also dozens of other government statistics that measure economic activity, all of which tell us how well businesses and consumers are doing.

Additional growth indicators include

• Corporate profits.

• Farm income.

• Industrial production.

• New housing construction.

• Personal income.

• Retail sales.

Growth is important for an economy.

Help Wanted

GDP and other growth indicators measure the amount of activity taking place in an economy. Another way to measure activity is to look at inactivity.

One important measure of inactivity is the unemployment rate. This indicator tells us the percentage of workers who are out of work. This is a good way to measure the health of an economy. When only 5 percent of people are out of work, the economy is much healthier than when the unemployment rate is 10 percent.

As with GDP, comparisons across time provide a more useful perspective. If the unemployment rate is declining, that means more people are working. The economy is getting stronger. If the unemployment rate is rising, then the opposite is true.

Did You Know?

A country’s unemployment rate might actually be higher than what is officially listed. This is because many people who are out of work do not report this fact to the government, so they do not get recorded as part of the total percentage of unemployed citizens.

When a lot of people are out of work, the economy is not healthy.

The Rising Cost of Living

People from an older generation remember when a penny or a nickel was worth much more than today. There is a reason your grandparents could buy candy for a penny, while you have to spend close to a dollar. It is called inflation.

Inflation is a feature of economic systems that demonstrates that as time passes, things get more expensive. This might seem unfair if incomes always stayed the same. But usually incomes go up as prices rise. This helps offset increases in the cost of living.

Still, not every good or service increases in price over time. In fact, some prices actually decrease over the years. When a technology is very new, it is often quite expensive. As technology advances and new ways are discovered to produce something more efficiently, the price of an item might actually decrease. Examples of items that have decreased in price after first being introduced are radios, televisions, and personal computers.

The average price for a gallon of gas rose during a relatively short period of time. Think about possible reasons why the price continues to rise today.

The Increasing Price of Gas

1977: $0.55

1980: $1.00

1990: $1.25

2000: $1.55

2006: $3.00

2014: $3.56

The Inflation Rate

The U.S. government measures inflation with something called the Consumer Price Index, or CPI. The CPI is the average price of a group of goods and services such as food, transportation, and medical care. As the CPI rises, economists can get an overall picture of how fast prices are rising. This lets them determine what the inflation rate is.

The inflation rate is an important economic indicator. It lets people know how fast they should expect prices to rise.

The inflation rate can also be used to adjust for the effects of inflation. Doing this shows how much something in the past would cost today. For example, by calculating the inflation-adjusted price, you would find out that something you paid $5 for in 1990 would cost $8.90 in 2013.

It is easy to see the effect of inflation — did you ever see gas selling so cheaply?

What Your Money Can Buy

Prices are always going up, but not all prices rise at the same rate. Some prices go up faster than the inflation rate, while others go up more slowly.

If the actual price and the inflation-adjusted price are about the same, then the price has not really gone up, even though the number on the price tag is bigger.

For example, when gas went from 55 cents per gallon in 1977 to $1.55 in 2000, that was about equal to the inflation rate. So, gas cost about the same. But inflation would have made that $1.55 in 2000 into only $1.82 by 2006. When gas went up to $3, it rose faster than inflation.

Often, when prices go up faster than the inflation rate, it is a result of high demand. For instance, football is a more popular sport today than it was in 1975. So prices for tickets to the Super Bowl have increased more than three times as fast as the inflation rate. Other areas where prices have outpaced inflation include medical care and college education.

If prices rise at 4% and your income does the same, you are not harmed in the short run. But you might be harmed in the long run as you try to save for college or retirement if your savings cannot keep up with rising costs over a long period of time.

As time goes by, a dollar buys less and less.

Knowledge Is Power

Decision making is an important part of the game of economics. Making good decisions requires knowledge, skill, and information.

The indicators give economists and others a fairly good picture of how the economy is doing.

Economic indicators have an influence on the decision-making process. For instance, the inflation rate is useful for making smart decisions. Imagine that you want to buy an expensive new TV. If the inflation rate is high, it might make sense to buy the TV now before it gets much more expensive. On the other hand, it might make more sense to save the money because your rent and food bills are going to go up, too. Economic indicators are like signposts guiding you along an economic path. If read correctly, they can help an economic player arrive at safely at a destination.

People who try to make money in the stock market use all kinds of information to make predictions.

Doctoring the Economy

Economists are like doctors who try to determine the health of the economy. They use different measures, such as gross domestic product, growth rates, the unemployment rate, and the inflation rate. These indicators provide useful information when it comes to making good decisions.

Unfortunately, unlike doctors, economists cannot cure economic sickness. They can diagnose the problems, but they leave it to us to make our own economic choices.

Economists examine the health of the economy.

Someone born in 1950 lived without computers for some 30 years, and then witnessed the evolution of laptops and the Internet. Later, he or she witnessed the invention of the cell phone and then the development of smart phones.

All this technology has drastically changed the way people live. Changes in technology affect the economy on a large scale, which in turn affects how people play the game of economics.

What could be coming next? We do not know exactly, but we do know there is something coming. And it will probably be amazing.

Humans are always striving to do things better. Developing technology is one way to do this. The advancement of technology leads to greater speed, higher production, and increased efficiency.

Many people think of technology as electronic devices such as computers, cell phones, and other wireless tools. These kinds of devices can certainly improve results in many areas.

Computers help people work faster by making it easier to find, organize and reorganize information. Cell phones make it easier to get in touch with others. Some devices can include a calendar, address book, computer, camera, and phone all in one.

But technology includes more than just smaller, faster, more powerful electronic devices. Technology is any new advancement in or application of science that improves results.

The Power of Machines

For thousands of years, humans have been inventing things to make their work easier, faster, and more efficient. Many of the things people have invented are machines that use power to replace human or animal effort.

You can get from one place to another in a horse-drawn carriage. But the car, once known as the «horseless carriage,» gets you there much faster. The car improves the ride.

The horse-drawn carriage was a technological development a long time ago. It provided an alternative to walking for those who could afford it. With a horse-drawn carriage, people could get to places much faster and with less effort.

The car increased that speed and reduced that effort even more.

Build a Better Mousetrap

New technologies are invented every day. In most cases, today’s devices are not made to replace human or animal effort. Instead, they are designed to replace older, less powerful machines with newer versions.

For example, the telephone replaced the telegram. While the telegram was the fastest way of getting messages from one place to another in its time, the telephone further increased the speed of communications.

More recently, cell phones are quickly replacing home phones and other so-called «land lines.» Home phones make calls fine, but their area of use is limited. Cell phones can go anywhere. This development makes an already powerful technology even more effective.

A Method to Their Madness